BP stock’s high yield and low P/E

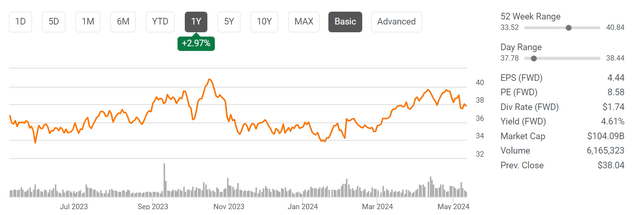

BP‘s (NYSE:NYSE:BP) stock price has largely been moving sideways recently. As seen in the chart below, its price increased only about 3% in the last year, while the S&P 500 enjoyed one of the best years with more than 20% gain. There are certainly good reasons for such lag, and I will touch on several of them later. Despite some profit headwinds, BP has been improving its finances. As such, the goal of this article is to argue that the combination of price stagnation and improvement in its financials has created a sizable value-price gap and a highly asymmetric return/risk profile.

Seeking Alpha

As a reflection of this combination, BP now features a dividend yield close to 5% (4.61% to be exact) and only an FWD P/E of 8.58x as you can see from the chart above. Whenever I see such a combination of high yield and low P/E, my experiences have taught me to immediately check on the following two potential pitfalls:

- The danger of a dividend cut in the near future.

- The danger of buying a terminally stagnating business at a cheap price.

In BP’s case, I see neither danger as to be detailed in the remainder of this article.

BP stock’s Dividend safety and share repurchases

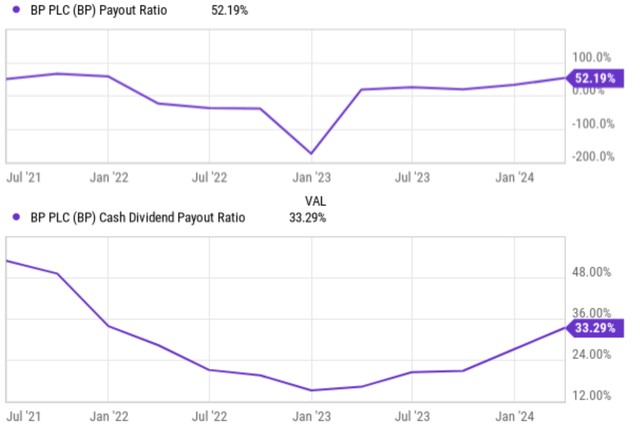

Let’s examine the danger of an imminent dividend cut first. The next figure shows BP’s EPS payout ratio (top panel) and cash dividend payout ratio (bottom panel) in recent years. As seen, the EPS payout ratio is about 52%, quite safe in both absolute terms (i.e., it is only about ½ of the earnings) or relative terms (i.e., relative to its historical track record or sector averages). In terms of the cash payout ratio, the picture is even stronger. As seen, the EPS payout ratio is only 33% currently.

Looking ahead, I expect BP’s shareholder-friendly policies to continue. Given the current safe levels of payout ratios, I expect the opposite of a dividend cut – I expect plenty of room for the annual dividend distribution to increase in the next few years.

Seeking Alpha

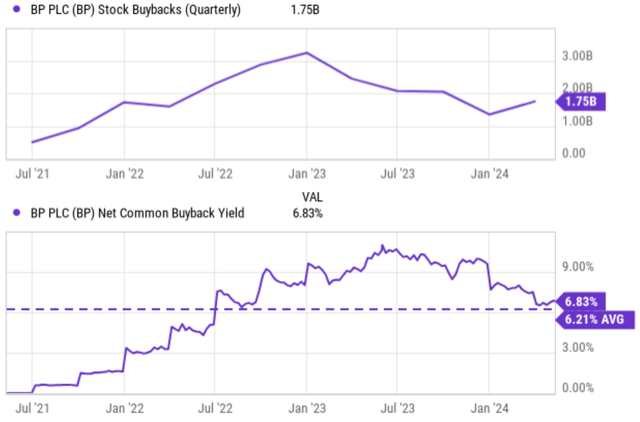

As another demonstration of its dividend safety (and also another demonstration of its generous shareholder-friendly policies), BP has been buying back stocks at a decent clip. And it has recently increased the repurchase authorization through the first half of this year.

As seen in the top panel of the chart below, BP has been allocating a sizable amount of capital toward share repurchases in recent years. The quarter buyback peaked at over $3B early this year and totaled $1.75B in the past quarter. To better contextualize the magnitude of such buybacks, the bottom panel shows its net common buyback yield. As seen, the buyback yield peaked at over 10% recently, averaged about 6.21% in the past 5 years, and currently sits around 6.83%. These numbers are even higher than its already generous cash dividends.

Lastly, bear in mind that repurchases are far more potent than cash dividends in the long run, especially made at the current low P/E multiples. There are many reasons why I prefer buybacks (and they are all detailed in my other articles), here I will quote the top 1 factor: tax, a factor that is actually in our control (while most factors are ultimately out of our control in investing):

Stock buybacks are way more tax-efficient for both the company and the shareholders. With a stock buyback, shareholders don’t realize any capital gains or losses until they actually sell their shares. This allows them to defer paying taxes on any appreciation in the stock price. In contrast, with cash dividends, first, they are taxed twice. First, it is taxed at the company and then shareholders owe taxes again as income once they receive the money – regardless of whether they reinvest the dividend or spend it.

Seeking Alpha

BP stock’s Growth potential

Now let me move on to examine the second potential danger: the danger of buying a permanently stagnating company at a cheap price.

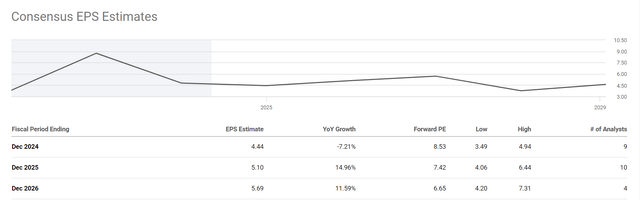

The chart below shows the consensus EPS estimates for BP stock in the next 3 years. As seen, overall, analysts expect BP’s EPS to grow in the next few years. The consensus estimates point to an EPS of $4.44 in fiscal 2024, representing a modest decline YOY. Then the market expects it to increase to $5.10 and $5.69 by the end of fiscal 2025 and 2026, respectively. These numbers represent a year-over-year growth of 14.96% in 2025 and 11.59% in 2026.

Seeking Alpha

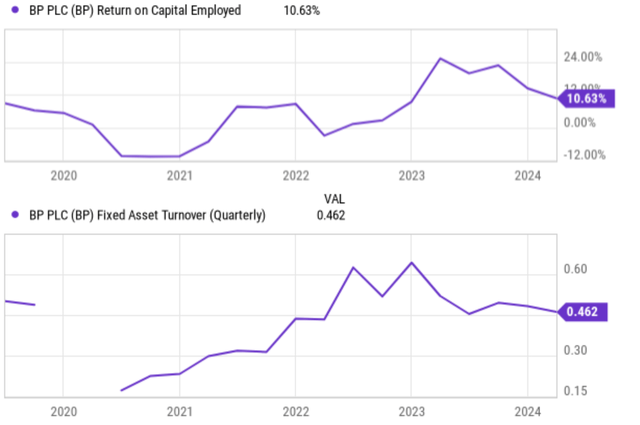

I certainly see good reasons for the decline in FY 2024. BP has been facing some challenges in its production volumes lately. As you can see from the next chart below, its ROCE (return on capital employed) has dropped significantly from a recent peak of around 24% to the current level of 10.6% only. And a main cause for this drop is asset utilization, dropping from over 0.6x a few quarters ago to the current level of 0.46x only. There are a few other ongoing headwinds to compound the issue. The current commodity prices are relatively low compared to the average prices in recent years. Higher labor costs and inflation also added to the profit pressure.

Looking ahead, I see these issues as temporary only and expect a robust EPS rebound in the next 1~2 years as consensus projected. Among all the ROCE drivers, asset turnover is a knob that is largely within management’s control. And based on management’s latest outlook, upstream production levels are poised to improve in the next few quarters. Oil prices are of course out of management’s control. But my outlook for oil prices is quite optimistic, as detailed in a recent article on Chevron (CVX). Finally, the company has a few other initiatives that can help growth in both the near and long term. Its renewable operations are slowly expanding. The company’s alternative energy pipeline is growing quarter over quarter, particularly in the Americas and Asia Pacific region. Bolt-on acquisitions provide another growth catalyst. For example, BP recently announced the acquisition of an energy supplier in Germany.

Seeking Alpha

Other risks and final thoughts

In terms of downside risks, BP faces largely the same set of risks common to oil stocks. As aforementioned, the large volatility in oil prices is an ever-present risk for oil stocks. Geopolitical instability, economic fluctuations, and even shifts in consumer behavior can trigger oil price swings that significantly impact profitability. Additionally, the global push for cleaner energy sources presents a long-term challenge. BP has some initiatives in this area, but they are all in an early stage in my view (for example, BP is committed to achieving net-zero emissions by 2050). These initiatives and commitment to clean energy may lead to higher upfront costs in the short term.

All told, my conclusion is that BP presents a compelling BUY opportunity for value-oriented investors under current conditions. The stock trades at a very low forward P/E ratio and offers an attractive dividend yield. The company’s aggressive share buyback program further enhances shareholder returns. The buybacks actually return far more capital to shareholders than its already-generous cash dividend, especially when adjusted for taxes. While EPS growth may face some headwinds in the near term, I expect a solid rebound in the coming 1~2 years. These positives far outweigh the potential risks in my view, resulting in a very skewed reward/risk profit.

Read the full article here