Co-authored with “Hidden Opportunities.”

Charlie Munger is a billionaire investor and the Vice Chairman of Berkshire Hathaway (BRK.A)(BRK.B), renowned for his success with value investing, wisdom, and decades of legendary collaboration with Warren Buffett on major financial decisions.

It is always assumed that significant accomplishments require hard work. From our careers to personal relationships, we must put considerable effort into being successful, so it must be the same with investing, right? Wrong. Continuous tinkering and frequent trading aren’t always as beneficial as adopting a well-thought-out strategy that meets your desired goals. Add patience to the equation, and you have a winning formula.

“Your intelligence won’t make you a great investor if you have little emotional control. Adopt a long-term focus, stay patient, and avoid taking action impulsively.” – Charlie Munger.

To have control over one’s emotions is easier said than done, but it is a necessary skill for successful investors. It requires staying invested through volatile markets and uncomfortable drawdowns as long as the investment meets the identified initial requirements.

“The big money is not in the buying and the selling but in the waiting.” – Charlie Munger.

I have no problems waiting because my picks pay me big dividends to stay patient. Here are two picks that will make it worth your while.

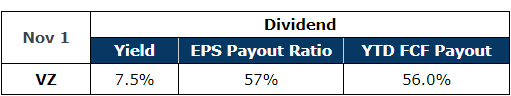

Pick #1: VZ – Yield 7.5%

Verizon Communications Inc. (VZ) is the largest U.S. telecom company by FY 2022 revenues. Due to aviation safety concerns reported last year, major U.S. telecom carriers agreed to delay the usage of the 5G C-band spectrum until aircraft altimeters were retrofitted. VZ can now use its $53 billion purchase (from 2021) to offer improved bandwidth in 406 markets, 4 months ahead of schedule.

The company continues to report declining capital expenditure as the bulk of its 5G and fiber investments are now translating to growing FCF (Free Cash Flows), which adds to dividend safety and enables debt reduction efforts. For FY 2023, management has forecasted $18 billion in FCF, which comfortably covers the roughly $11 billion in annual dividend payments at a sustainable 56% payout ratio.

Author’s Calculations

For FY 2024, analysts project $19 billion FCF, which would continue to provide comfortable coverage for another 10% increase in annual dividend spend to $12 billion (at a 63% payout ratio).

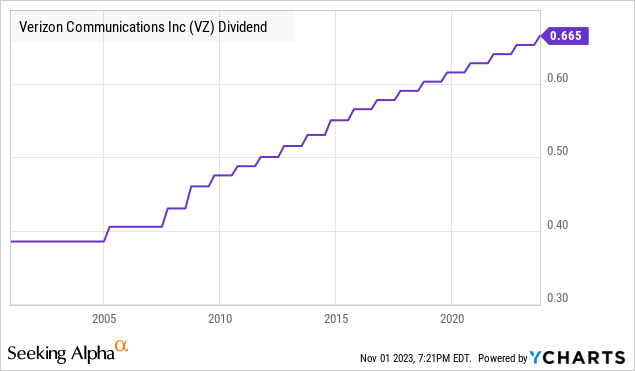

When the markets were busy worrying about the inflation metrics, employment numbers, and the Federal Reserve’s reaction, Verizon did what it does best; raised the common stock dividend for the 17th consecutive year. The company’s current $0.665/share quarterly dividend calculates to an 8.4% annualized yield. Being a C-corp, VZ’s dividend payments are considered QDI (Qualified Dividend Income).

Amidst elevated interest rates, investors are fleeing the telecom sector as these companies carry higher debt levels on their balance sheets. At the end of Q3 2023, VZ reported a net unsecured debt to EBITDA of 2.6x. The telecom giant maintains an A- rated balance sheet, the highest among U.S. telecom peers. The company continues debt reduction efforts and reported $122.2 billion in net unsecured debt as of September 30 (down from $126 billion after Q2). The company maintains a comfortable position to cover its short-term debt maturities.

Last month, the U.S. environmental regulator revealed that soil sampling for lead near telecom cables indicated no threat to the health of the nearby population or the need for any immediate government response. We thank Mr. Market and Wall Street for all those stock downgrades in fear and anticipation of billions in settlements and penalties. After all, this resulted in the dividend yield swelling to all-time-high levels without any impact on the safety of the payment.

VZ experienced a sizeable jump in stock price since the Q3 earnings because Wall Street was pleasantly surprised by what we saw coming from a mile away. The company trades at a forward P/E of 7.3x and EV/EBITDA of 6.4x, indicating that it is an extremely undervalued stock with a safe dividend and excellent prospects for valuation improvement as FCF grows and deleveraging continues.

Pick #2: DFP – Yield 7.7%

The primary driver of preferred share values is interest rates. When rates are low, preferred securities are sought after. And when rates are elevated, investors leave them in favor of CDs and Treasury funds. But if observed strictly from an income standpoint, these securities continue making distribution payments despite price drops, and this forms the basis of our next pick.

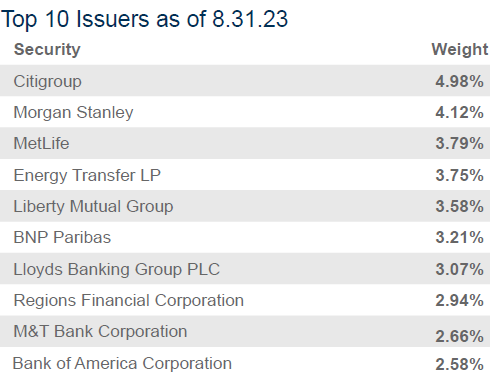

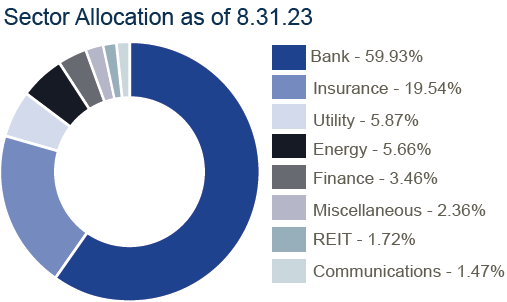

Flaherty & Crumrine Dynamic Preferred and Income Fund (DFP) is a closed-end fund, or CEF, composed of fixed-income securities primarily in banking, insurance, and utility companies. Source.

DFP Fact Sheet

DFP Fact Sheet

Investors assume that DFP as a fund is getting permanently destroyed by operating with significant leverage as borrowing costs rise. Let us examine why this isn’t the case.

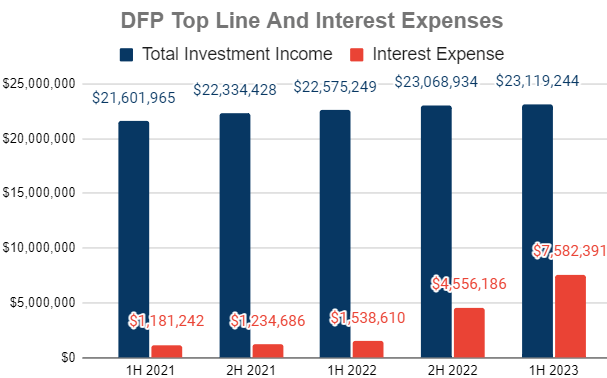

DFP’s top line – Total Investment Income, is primarily composed of dividends and interest income. Since 1H 2021, we have seen a steady rise in this metric, indicating that the portfolio’s ability to earn has been well-maintained since the zero-interest days.

Author’s Calculations

Yet, we see a substantial increase in interest expenses, which are weighing down on the bottom line, the NII (Net Investment Income). DFP will continue experiencing headwinds until interest rates stop rising, which is a lot closer at this time. Most importantly, DFP does not cannibalize its portfolio to maintain the dividend, ensuring excellent prospects of NAV recovery (and subsequent distribution increase) when the interest expense headwinds subside.

“While higher interest rates have impacted asset values, they have also squeezed the Fund’s distributable income. The Fund uses leverage to enhance distributable income, earning the positive spread between asset yields and leverage cost. A slow increase in short-term rates would have allowed for a measured transition, but the pace and size of rate hikes have caused leverage costs to increase materially and quickly. Leverage continues to provide more distributable income compared to no leverage, but the spread has narrowed, and incremental income from leverage declined. The Fund’s goal is to pay out dividends consistent with portfolio earnings, and not maintain an artificially high dividend that is actually a return of shareholders’ capital. Accordingly, we have adjusted the Fund’s dividend lower over the course of the year to reflect its lower distributable income.” – DFP Annual Report.

This approach ensures that DFP’s NAV will function like a rubber band, set to regain its original state when the rate cycle shifts. As shareholder distributions are paid from NII, since May 2022, DFP shareholders have received steadily declining monthly distributions. The current monthly payment is 34% lower as a result of the steepest pace of rate hikes in 40 years.

During 1H 2023, DFP’s daily weighted average annualized interest rate was 5.429%. With the CEF’s leverage carrying a 91% fixed-to-float exposure, rate cuts will directly reduce the fund’s bottom line.

“The best thing that happens to us is when a great company gets into temporary trouble…We want to buy them when they’re on the operating table.” – Warren Buffett.

DFP currently trades at a massive 15% discount to NAV, making it an excellent bargain as the global economy awaits a rate cliff next year. When reducing borrowing costs, DFP will see higher NII, which will result in higher distributions. A 7.7% yield from this discounted and well-managed fixed-income CEF for your rate-agnostic portfolio.

Conclusion

Investors often assume that they should hit home runs to be financially successful. It is always believed that one must either win a lottery or pick the next Amazon (AMZN) before it flies off to the moon. And in that process, investors often end up hurting themselves and their financial future.

Charlie Munger has always insisted that an even temperament is more important than high IQ levels and that simple, repeatable techniques can reward big over the long term. His investment insights, backed by decades of experience and remarkable patience with his investments through brutal recessions, offer valuable lessons for all investors, income-focused or otherwise.

“It’s waiting that helps you as an investor, and a lot of people just can’t stand to wait” – Charlie Munger.

When markets are bearish, some fundamentally strong businesses can be purchased at deep discounts. This is what is happening in the current market, and we identify two income-focused picks with up to 7.7% yields to brighten up your retirement.

Read the full article here