A Quick Take On Criteo S.A.

Criteo S.A. (NASDAQ:CRTO) is a digital marketing software and service provider for retail advertisers seeking improved connections with customers and prospects.

I previously wrote about CRTO with a Buy outlook.

Criteo S.A.’s Europe growth outlook is weaker than I expected and the stock’s valuation appears full at its current level.

Given the backdrop of worsening consumer confidence, I’m changing my outlook to Neutral [Hold] for the near term.

Criteo Overview And Market

France-based Criteo was founded to provide a range of online advertising demand-side software solutions and related services for businesses worldwide.

The firm is led by CEO Megan Clarken, who was previously Chief Commercial Officer at Nielsen and previously held various technology consulting positions.

The company’s main offerings include the following:

-

Commerce Growth – automated acquisition

-

Commerce Max – demand side retail-centric media

-

Commerce Yield – future for large media buyers

-

Commerce Grid – future for specialty retailers.

Criteo seeks customers through direct sales and marketing efforts, social media, search engines, partner referrals, advertising agency outreach and various industry events.

According to a 2022 market research report by Fortune Business Insights, the worldwide market for demand-side advertising was estimated at approximately $17 billion in 2021 and is forecast to reach $92 billion by 2029.

This represents a forecast CAGR of 23.7% from 2022 to 2029.

The primary reasons for this expected growth are increasing internet and mobile device usage, growing demand for data-driven advertising, the need by advertisers to increase the efficiency of their online marketing programs and continued popularity of various video and audio formats, increasing the complexity of online advertising environments.

Major competitive or other industry participants include:

-

The Trade Desk

-

AdRoll

-

Google

-

Adobe

-

Verizon Media

-

AppNexus

-

Facebook

-

MediaMath

-

Viant Technology

-

Taboola

-

Yahoo!

Criteo’s Recent Financial Trends

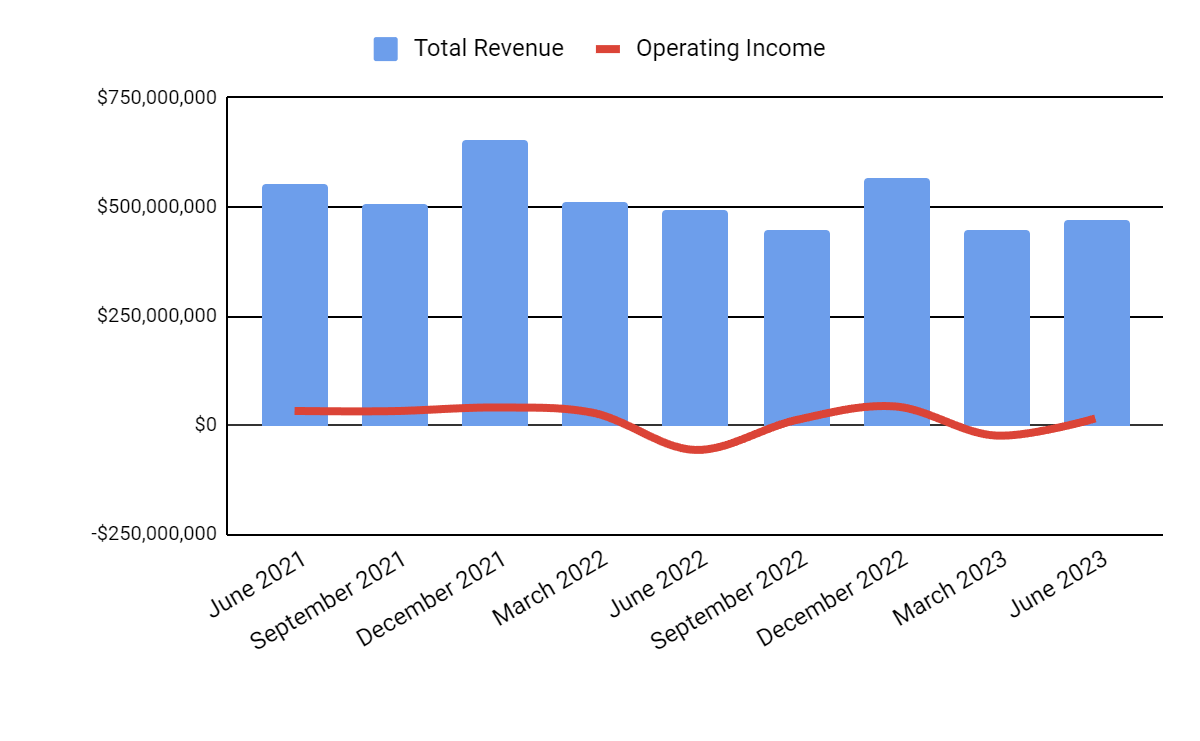

Total revenue by quarter has trended lower while operating income by quarter has increased sequentially:

Seeking Alpha

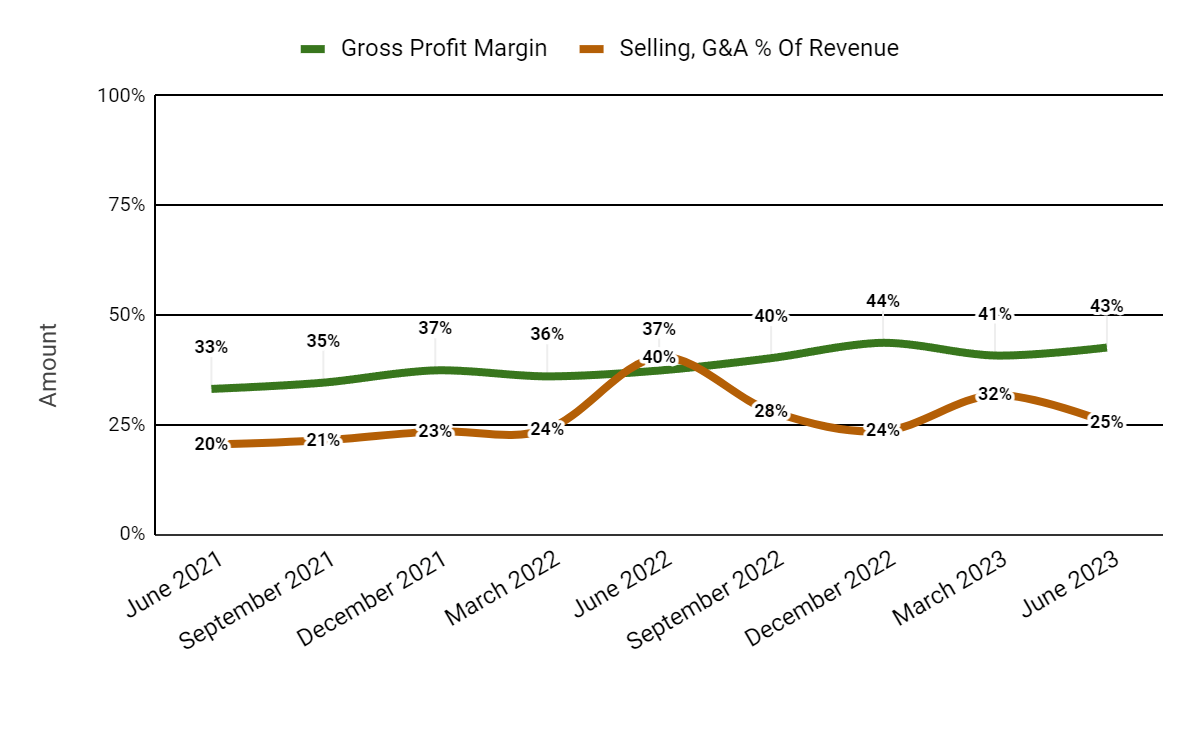

Gross profit margin by quarter has moved higher in recent quarters; Selling and G&A expenses as a percentage of total revenue by quarter have trended lower unevenly:

Seeking Alpha

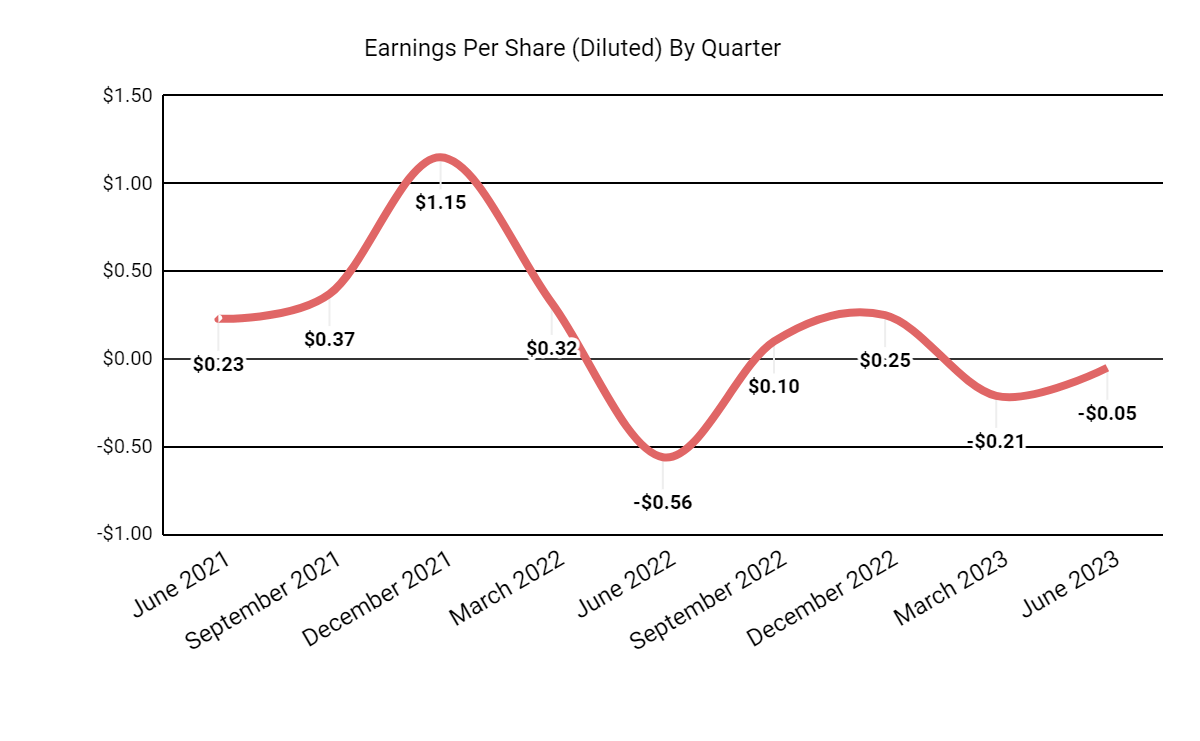

Earnings per share (Diluted) have fluctuated mostly in negative territory in the two most recent quarters.

Seeking Alpha

(All data in the above charts is GAAP.)

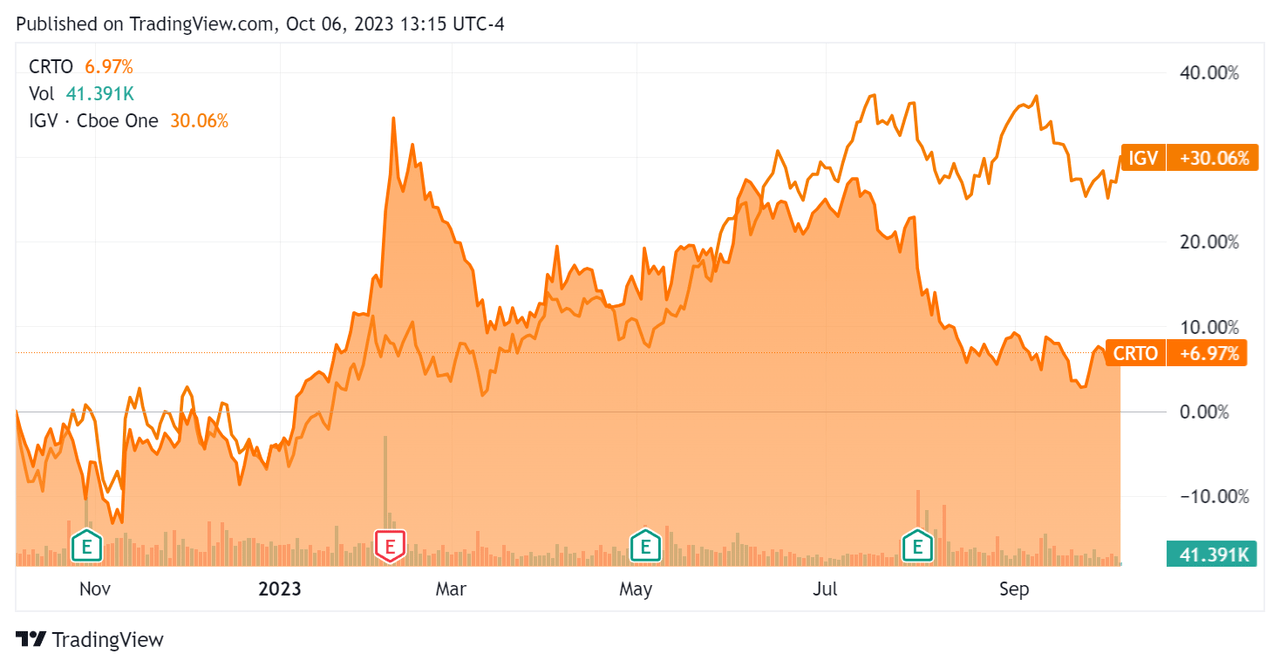

In the past 12 months, CRTO’s stock price has risen only 6.97% vs. that of the iShares Expanded Tech-Software Sector ETF’s (IGV) rise of 30.06%:

Seeking Alpha

For balance sheet results, the firm ended the quarter with $244.3 million in cash, equivalents and short-term investments and only $0.7 million in total debt, of which $0.6 million was categorized as the current portion due within 12 months.

Over the trailing twelve months, free cash flow was $96.9 million, during which capital expenditures were $113.5 million.

The company paid $95.9 million in stock-based compensation in the last four quarters, the highest trailing twelve-month figure in the past eleven quarters, and a substantial increase over recent quarters.

Valuation And Other Metrics For Criteo

Below is a table of relevant capitalization and valuation figures for the company:

|

Measure [TTM] |

Amount |

|

Enterprise Value / Sales |

0.8 |

|

Enterprise Value / EBITDA |

9.1 |

|

Price / Sales |

0.9 |

|

Revenue Growth Rate |

-11.2% |

|

Net Income Margin |

38.0% |

|

EBITDA % |

8.4% |

|

Market Capitalization |

$1,600,000,000 |

|

Enterprise Value |

$1,480,000,000 |

|

Operating Cash Flow |

$210,380,000 |

|

Earnings Per Share (Fully Diluted) |

$0.09 |

|

Free Cash Flow Per Share |

$1.68 |

(Source – Seeking Alpha.)

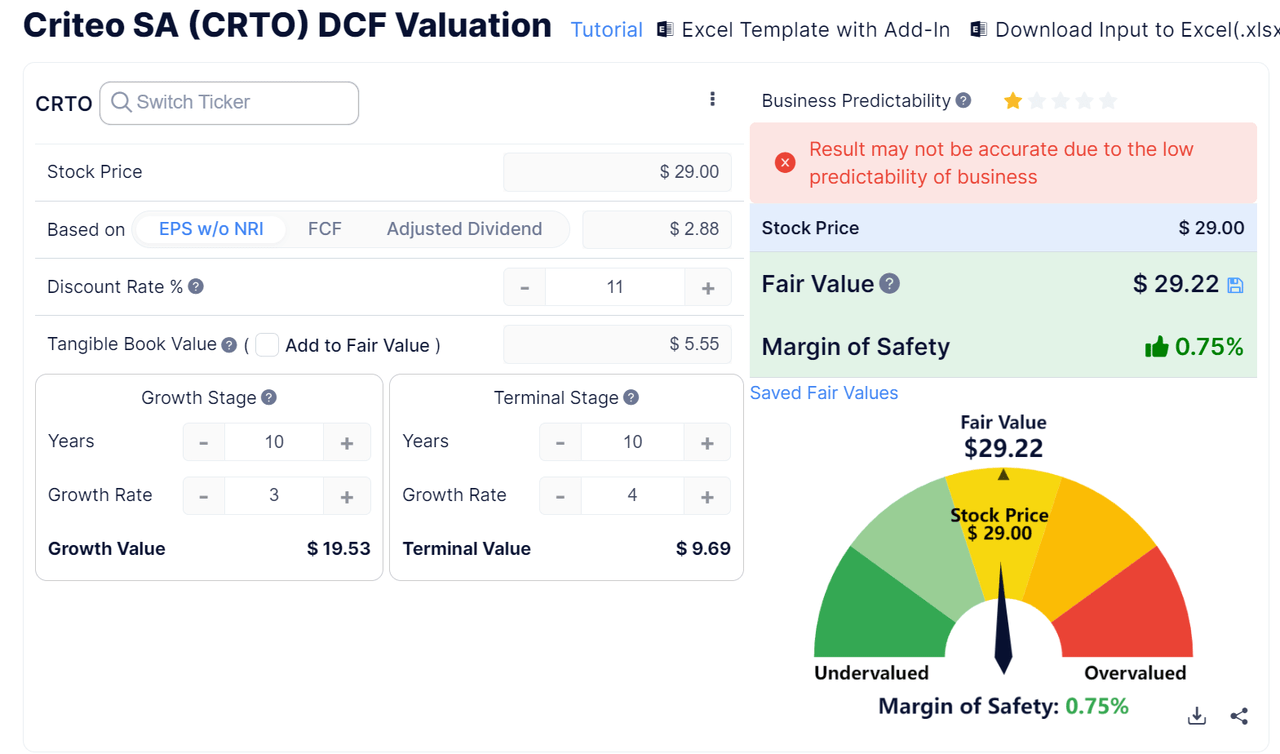

Below is an estimated DCF (Discounted Cash Flow) analysis of the firm’s projected growth and earnings:

GuruFocus

Based on the DCF, the firm’s shares would be valued at approximately $29.22 versus the current price of $29.00, indicating they are potentially currently fully valued.

CRTO’s most recent unadjusted Rule of 40 calculation was negative (2.8%) as of Q2 2023’s results, so the firm needs substantial improvement in this regard, per the table below:

|

Rule of 40 Performance (Unadjusted) |

Q4 2022 |

Q2 2023 |

|

Revenue Growth % |

-10.5% |

-11.2% |

|

EBITDA % |

6.2% |

8.4% |

|

Total |

-4.3% |

-2.8% |

(Source – Seeking Alpha.)

Sentiment Analysis

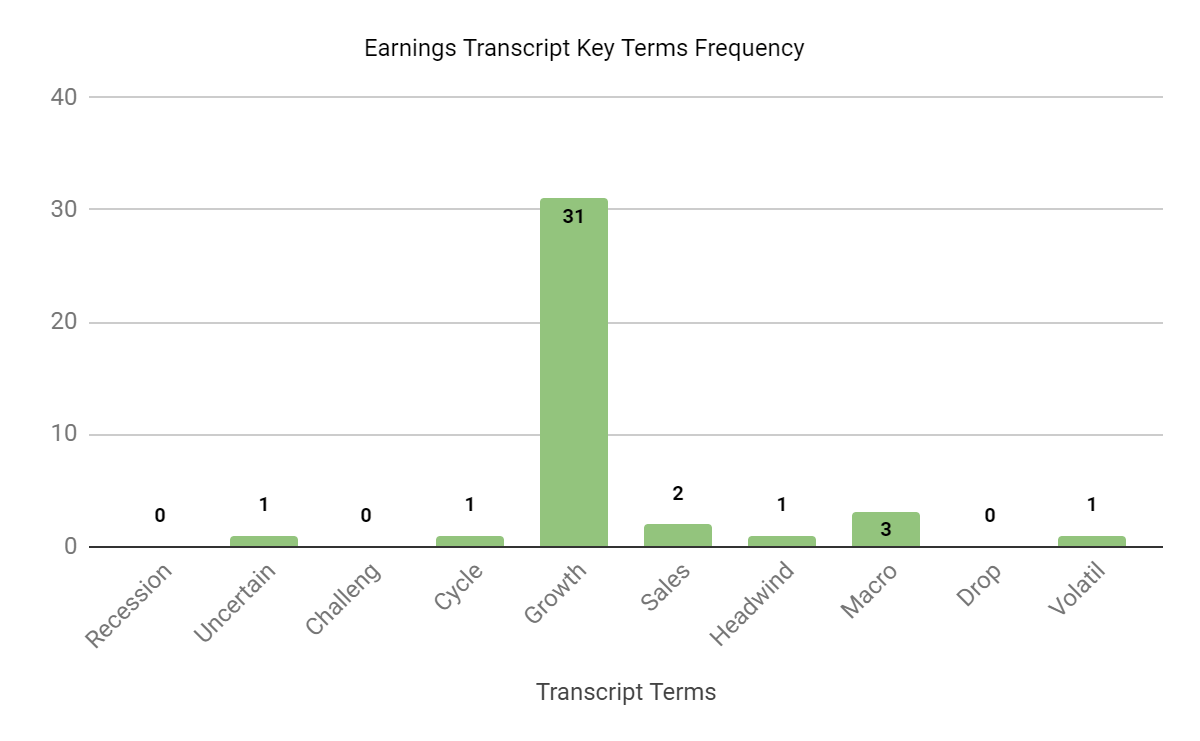

The chart below shows the frequency of certain keywords in the most recent management earnings conference call with analysts:

Seeking Alpha

The chart shows the firm is experiencing continued macro uncertainties for ‘market factors’.

Analysts asked management about the more difficult spending environment, its Commerce Grid platforms and AI initiatives.

Leadership said that European spending was lower, especially in France, where there were government measures to control inflation, which reduced brand spending.

The firm is seeing increasing spend for its Commerce system from large brands.

On AI, management said the company has a mature generative AI capability and is using copilot functions for development to enhance customer activities such as media planning, sponsored products, chatbots and on-site search.

Commentary On Criteo

In its last earnings call (Source – Seeking Alpha), covering Q2 2023’s results, Criteo S.A.’s management gave prepared remarks that highlighted the imminent launch (now launched) of its Commerce demand and supply side platforms.

A number of retailers and brands have already signed up to use the new systems, which enable users to buy retail media inventory onsite and open Internet media offsite.

Its Commerce Grid supply-side platform enables media owners to manage their inventory and sell it programmatically to commerce-centric buyers.

Management also noted its new relationship with Uber (UBER), which it believes “really shines a light on our ability to go beyond retail media.”

Total revenue for Q2 2023 fell by 5.3% year-over-year while gross profit margin increased by 5.2%.

The firm’s client retention rate was 90%, which management characterized as “resilient.”

Selling and G&A expenses as a percentage of revenue dropped an impressive 14.9% YoY, and operating income was $15.7 million during the quarter.

The company’s financial position is strong, with ample liquidity, almost no debt and strong free cash flow.

However, Criteo has paid quite a lot of compensation in the form of stock-based compensation, diluting shareholders in the process.

CRTO’s Rule of 40 performance has remained negative and in need of significant improvement.

In the past twelve months, the firm’s EV/Sales valuation multiple has risen a net of 33%, as the chart from Seeking Alpha shows below:

Seeking Alpha

A potential upside catalyst to the stock could include a strong uptake of its new C-Max demand and supply side platforms.

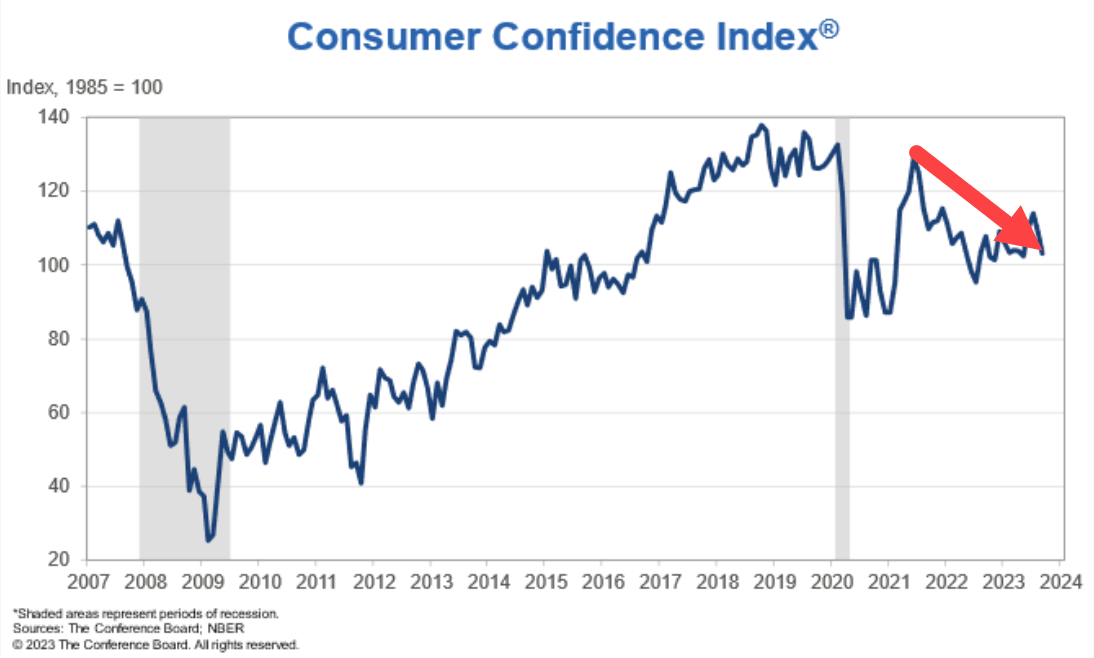

As of September 26, 2023, The Conference Board’s most recent gauge of U.S. consumer confidence fell to 103.0, continuing its downward trend in recent months, as the chart shows below:

The Conference Board

While the firm may be able to capitalize on its new C-Max system capabilities, the macro environment for customer spend is still softening as the cost of capital is rising and consumer confidence continues to slide.

I previously had a Buy opinion on Criteo S.A. stock, but now Europe and France within it are looking softer than before, and the U.S. may be on a downward slide.

My discounted cash flow calculation also suggests the stock may be fully valued here, so I am changing my outlook to a more conservative Neutral [Hold] rating for the near term.

Read the full article here