Back in June, I wrote that while expanding its small cell business represented a nice opportunity for Crown Castle (NYSE:CCI), the company was facing headwinds from the T-Mobile and Sprint merger and high interest rates. In addition, while the stock was trading below peers, I thought its valuation was not cheap. With the stock down about -20% since then, let’s catch up on the name.

Company Profile

As a refresher, CCI is a tower REIT (real estate investment trust) that owns, operates, and leases over 40,000 cell towers throughout the U.S. Over two-thirds of CCI’s revenue comes from its Tower segment. The majority of its towers are located in the top 100 U.S. markets, with over half in the 50 largest markets. About 60% of its gross profit is from land it leases, while 40% is from land it owns.

CCI’s Fiber segment, meanwhile, consists of 120,000 small cells on air and in backlog, and about 85,000 route miles of fiber. These assets are typically found in densely populated large markets.

The company has very high customer concentration, with Verizon Wireless (VZ), AT&T (T), and T-Mobile (TMUS) accounting for approximately 75% of its site rental income. Its tenant contracts have a weighted average remaining life of over 5 years.

Small Cell Opportunity And 5G CapEx

Last month, CCI hit the investment conference circuit hard, appearing at three conferences promoting the stock. One of the big themes continues to be its small-cell opportunity.

In its core tower business, the company faces a $200 million headwind from churn as a result of TMUS acquiring and consolidating Sprint. That will occur in 2025 when the contract ends. Excluding the Sprint churn, the company thinks it can grow its Tower segment by 5% a year through 2027, of which three quarters are already contracted out. As a result of its contracts, it said it will grow 3.75% even if activity goes down.

However, the company sees small cells as being able to add additional growth. At the RBC Capital Markets Global Communications Infrastructure Conference last month, CFO Daniel Schlanger discussed the small cell opportunity, saying:

So we got two orders, one from Verizon and one from T-Mobile that equated 50,000 small cell nodes. As I mentioned in my preamble, there’s 60,000 that we have on air. To get 50,000 orders is a huge amount, basically almost doubling the size of our business at a time now where towers are or plateauing coming down off the surge, we’re actually seeing the acceleration of small cell activity. Because we’re converting that 60,000 node backlog into revenue in ’23, ’24, ’25 and beyond. So in 2023, we expect to put 10,000 small cells on air. That is a doubling of the number of small cells as we put did in 2022 because you can see the shift from towers towards small cells or from, if you want to think about it this way, coverage to capacity. So towers give you coverage that everybody has the coverage. You get the bars on your phone, the way coverage and no capacity looks to you as a user is you get 5 bars and you go to your Facebook page and you get a little spinny thing. That means that the phone sees that the tower has this spectrum, but there isn’t enough capacity in the spectrum back to the deliver you anything. That’s actually where I think most people get the most frustrated. I have 5 bars, why do I have the little spinny thing. That’s small cell. And that’s where we think the world is going, and we’re seeing that in the activity of our customers right now. And we believe that on the 10,000 that we’re putting on air this year, we’re going to do at least 10,000 in 2024 and grow our business at double digits. So whereas tower growth has come down off of a very strong level, and we believe will plateau at some point and grow 5%, like I said, grow 5% through 2027. We think small cell growth is accelerating. And the whole premise is playing out. Not only is the architecture playing out like we thought we would. But it also allows us as Crown Castle to have access to a growth avenue that no other company has like we do. And we think that, that positions us to take advantage of growing data demand in the U.S., no matter how our customers want to address that data demand.”

As for the economics of small cells, the company said that it gets a 6-7% return for its first customer, which obviously by itself isn’t that great of a return on investment. However, when adding a second customer it moves up to around 10-12%, and then with a third it moves up to mid- to high teens. CCI also noted that the small cell build is about 50/50 between anchor buildouts and co-location buildouts. Co-location returns are even better because the capital intensity is much less since the fiber is already built and it just needs to add two pairs of strands on the small cell to add a customer.

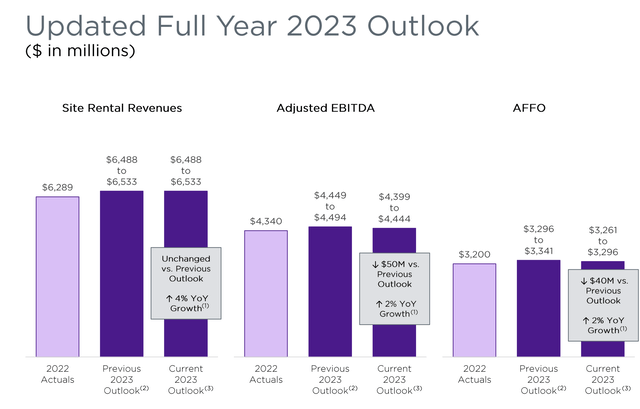

While small cells continue to look like a good opportunity, CCI did reduce its full-year guidance when it reported its Q2 results, as a result of lower expected tower activity for the rest of the year and higher interest rates.

Company Presentation

The company now expected FFO of $3.295-$3.330 billion and AFFO of $3.261-$3.296 billion, with those metrics down -$60 million and -$40 million at the mid-point, respectively. AFFO per share is projected to be between $7.50-7.58, down -9 cents at the mid-point from its prior outlook. Adjusted EBITDA is now forecast to be between $4.399-4.444 million, down -$50 million from prior guidance.

The company said it saw tower activity slow significantly in Q2. It noted that the surge in 5G investments has ended and that industrywide tower activity has declined by more than -50%. While it has solid MLAs in place, this reduced activity led the company to reduce its full-year service gross margin outlook by -$90. At the same time, it now expects an additional $15 million in interest expenses, as rates continue to rise.

While the TMUS-Sprint merger is a future headwind, the sudden pullback in 5G spending by telecoms is a new one that occurred pretty quickly. The stocks of wireless companies have struggled and their CapEx budgets have come under scrutiny, so maybe it shouldn’t be a total surprise of this slowdown.

CCI’s MLA contract structure helps mute the impact, so while disappointing, the overall impact on the business is rather modest. Higher interest rates, meanwhile, continue to eat into FFO. The company has tried to shift some of its variable debt into fixed debt, but this remains a headwind.

Valuation

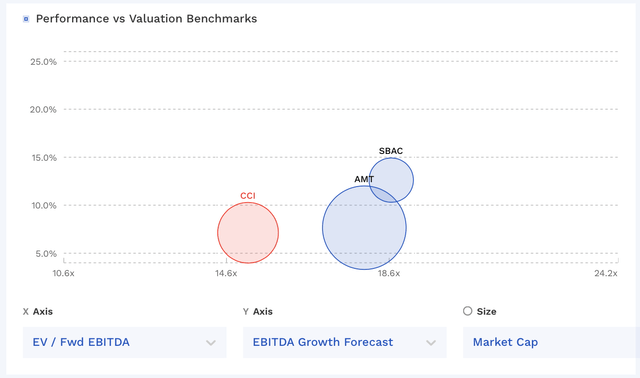

CCI trades at 15.2x EBITDA based on 2023 analyst estimates of $4.41 billion. Based on the 2024 consensus of $4.3 billion, the stock trades at a 15.5x multiple.

Based on an AFFO forecast of $7.54, it trades at an 11.8x price-to-AFFO ratio.

The stock trades at the lowest valuation of its two closest peers, American Tower (AMT) and SBA Communications (SBAC).

CCI Valuation Vs Peers (FinBox)

Conclusion

Over the past decade, CCI has traded at around a 20x EV/EBITDA multiple, so from a historical valuation perspective, the stock’s valuation is much more attractive now than in the past. However, with the Sprint churn and now 5G Capex pullback, the company isn’t really expected to grow over the next two years. At the same time, interest rates continue to eat into its FFO results, and obviously also increase its cost of capital as well.

Overall, I think that CCI is becoming more attractive, but given the continued headwinds and seeing the stock as a tax-loss candidate, I think there could be an even more attractive entry point down the road. As such, I’m going to remain neutral on the stock for now, as I just don’t think a higher interest rate environment with slowing industry growth is the best time to buy a tower REIT like CCI.

Read the full article here