Dollar stores have had a tough year.

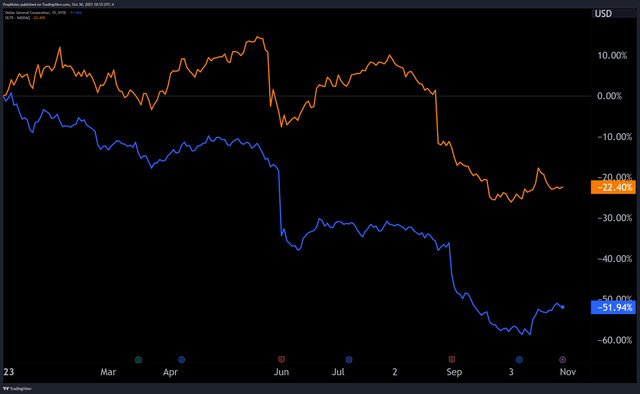

Since the start of 2023, the top companies in the category, Dollar General (NYSE:DG) and Dollar Tree (NASDAQ:DLTR), have seen their stocks collapse as a result of inflation, poor consumer spending trends, and massive shrinkage, which has dramatically affected financial results.

TradingView

While both companies are down, Dollar General has sunk further than Dollar Tree, mostly as a result of particularly (and unexpectedly) poor earnings.

As it seems likely that much of the macro and operational issues that each company has experienced will be transitory, the main question here is the following: Which stock is a better buy for your portfolio over the long term?

People will still be shopping at DLTR and DG in the future – but which is the company to own?

Today, we’re diving deep into each of these companies to find the answer.

Let’s jump in.

Financial Results

As we mentioned, DLTR and DG have not been performing well financially.

This is a result of a number of factors, with high inflation being the biggest concern. Inflation like we’ve seen has put tremendous pressure on consumers; most of all those at the lowest end of the income spectrum.

Given that dollar stores are typically the ones who service this demographic, it’s no surprise that results have been weak.

While it might be tempting to theorize that increased stress may actually improve results, you’d only be half right. Sales volume at stores has increased throughout the recent inflationary period. The issue has been with profitability.

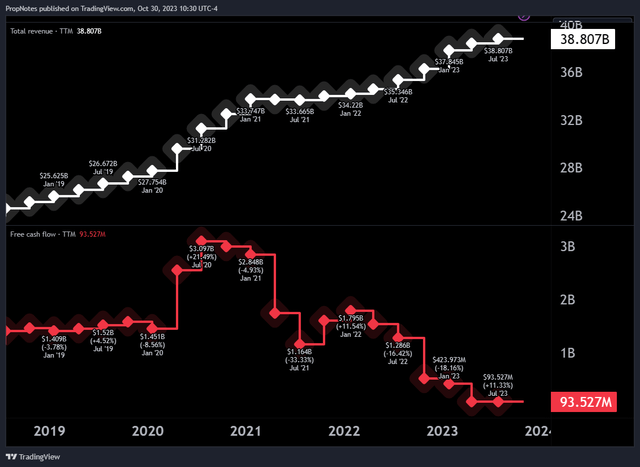

TradingView

Dollar General, as you can see above, has seen continued revenue growth due to increases in demand for low-cost staples.

However, given that dollar stores already operate on incredibly slim margins, eating the cost of inflation has been a part of doing business in the ‘dollar’ segment, where companies aim to sell $1-5 priced products en masse. Inflation has eaten into this value prop considerably, which has destroyed free cash flow margins. This is in combination with heightened operating costs, like rent and wages, which have also ballooned.

Compounding things are issues surrounding shrinkage.

As consumer stress has increased, many would-be customers have turned into ‘stealers’, or folks who take five-finger discounts on products. Whether silently or in broad daylight, theft at dollar stores is a growing trend and one that may also put other prospective shoppers off due to safety concerns.

Whatever the case is, theft is hurting results considerably. On DLTR’s recent earnings call, the word “Shrink” was used over 25 times, and CFO Jeff Davis had the following to say:

The headwinds we’re having in shrink are muting our margins right now. When you get a chance, you have an opportunity, take a look at the supplemental presentation that we have, you’ll see that shrink is continuing to — restrict our margins by about 75 to 80 basis points on a year-over-year basis.

We are taking the appropriate actions, we believe, in the organization to start to address that. As you know, shrink is a sort of a trailing indication because stores are shrinking over the course of the year. And as you’re adding new actions to reduce it, it takes time for those things to actually take hold. But between the sales mix and the shrink, once again, this is one of the things that have been muting the margin.

Rick Dreiling, the CEO, also mentioned that the company would be shifting strategy to counter these effects:

We are now taking a very defensive approach to shrink. And it’s taken us a quarter, but we have several new shrink formats that we’ll introduce in the back half of the year. And it goes everything from moving certain SKUs to behind the check stand. It has to do with some cases being locked up. And even to the point where we have some stores that can’t keep a certain SKU on the shelf just discontinuing the item. So, we have a lot of things in the works that’s going to roll forward.

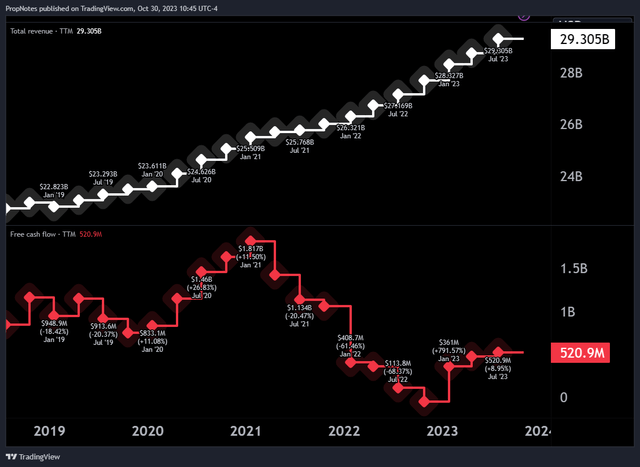

DLTR’s financial performance, as a result, looks similar to DG’s, with growing top-line sales but declining FCF:

TradingView

That said, DLTR looks to be in a better overall position. DG’s FCF margins have dropped to basically zero, while DLTR’s have remained far healthier as the company captured more than half a billion in profit over the trailing twelve-month period.

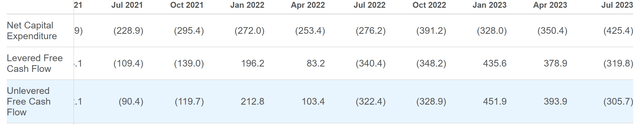

You can also see this dynamic at play when zooming into recent quarters.

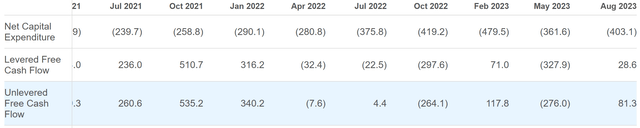

Since 2021, DLTR has seen bumpy FCF as a result of significant Capex in the business:

Capital expenditures were $425.4 million in the second quarter versus $276.2 million last year, reflecting elevated investment levels in new store openings and renovations, supply chain and information systems.

For fiscal 2023, we expect capital expenditures will total approximately $2 billion, with approximately 40% allocated towards maintenance Capex and the balance towards growth initiatives.

However, the business has still been able to chunk out some solid quarters over the last handful, which represents growth YoY for the first two 6-month periods of FY22 and FY23.

Seeking Alpha

However, in the case of DG, the company has seen a lower FCF ceiling since Q1 2022, which indicates potential issues with business economics and deteriorating execution.

Seeking Alpha

We expect this dynamic will occur into the future, and Q3 in particular, with DLTR putting up somewhat choppy but essentially improved cash flow figures as a result of better management vs. DG.

Thus, right now, we’d give the financial/operational advantage to DLTR as a result of the better overall performance during this difficult period.

Valuation

While DLTR has combatted the effects of inflation and shrinkage better than DG has, DG is currently priced more competitively as a result.

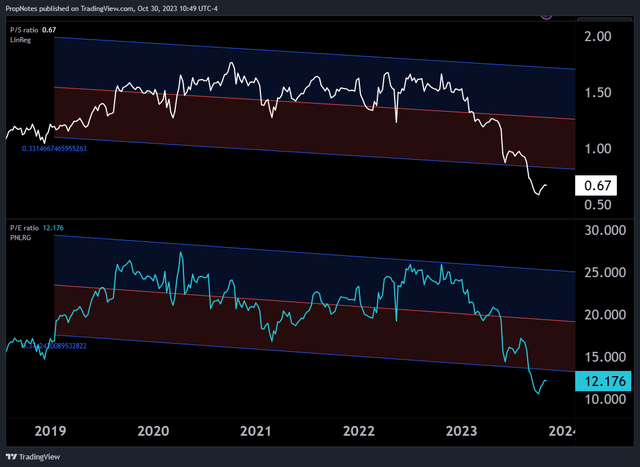

At the present moment, DG is trading at 0.67x top-line sales and 12x net income.

TradingView

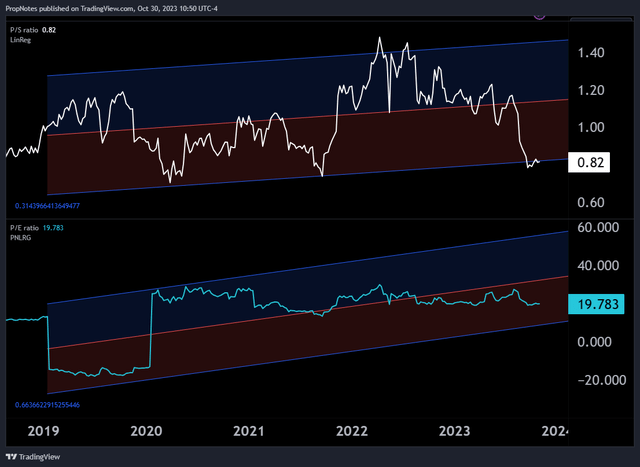

This compares with DLTR, which is priced a bit higher at 0.82x sales and 19x net income.

TradingView

While DLTR looks attractively valued on a historical basis with its sales multiple trading out below its 5-year standard deviation regression (which represents serious value), DG has seen both its top and bottom line multiples collapse below this level in a fit of extraordinary selling.

On a valuation basis, DG has the advantage.

Long-Term Prospects

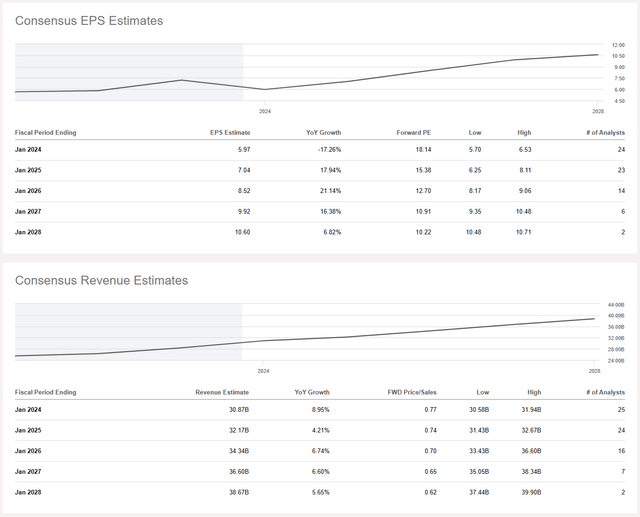

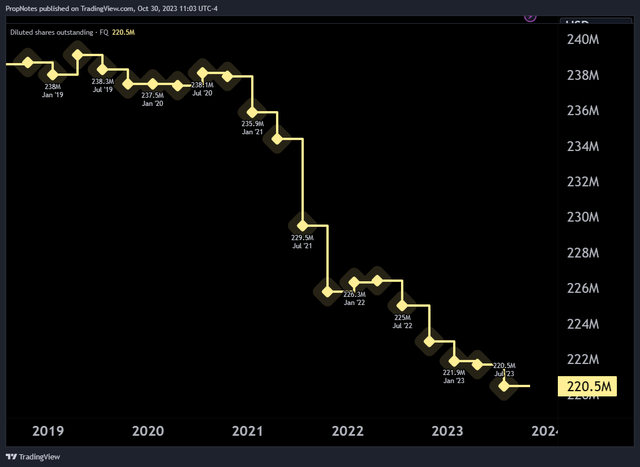

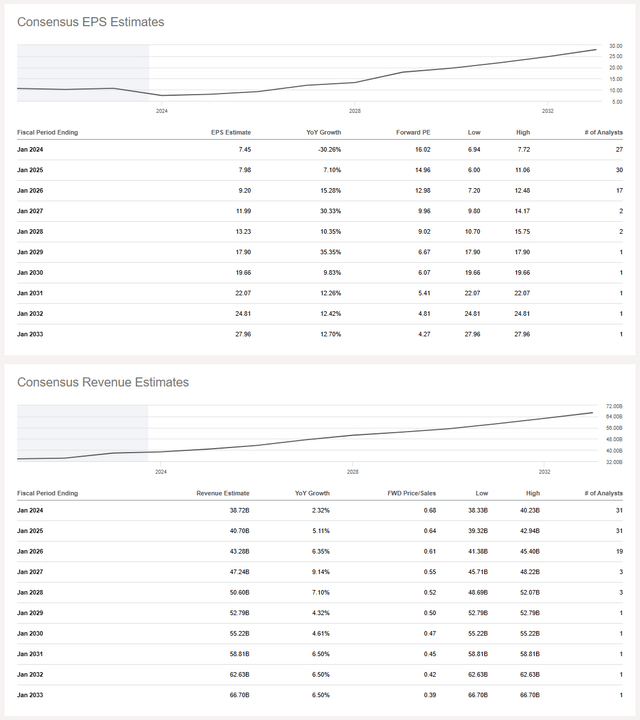

Finally, it’s key to see how analysts are projecting sales and earnings out into the future.

Right now, Wall Street sees DLTR results improving considerably out over the next few years.

Seeking Alpha

By 2028, analysts expect that DLTR will see 36 billion in sales with EPS near ~$10, which places the FWD multiple at around 10x earnings and 0.6x sales.

This model expects growth rates of ~6% over the interim for the top line, and continued growth in EPS as a result of the healthy buyback that has been in place for some time now.

TradingView

On the other hand, analysts see a somewhat different picture for DG.

Many expect EPS to bounce back quickly as a result of how bad 2023 has been but see revenue growth out into the future as a bit slower than DLTR.

Seeking Alpha

As analysts ourselves, we’re not sure where this top-line growth will come from. The company has already saturated a good portion of the available end market, especially when it comes to its most competitive rural locations.

Additionally, analysts predict that DG will see a lower valuation on future earnings and sales than DLTR will in 2028.

Obviously, these predictions are very far out but they give a good sense as to what the present market is thinking.

And, it’s thinking this: DLTR is a better business.

Bringing It All Together

All in all, the market seems to prefer DLTR as a stock to DG. The company has a higher premium multiple and better projected growth, and DLTR’s execution through this rough period has been miles better, especially when measured on free cash flow. Additionally, during the rout, DLTR’s stock has held up better than DG’s, which is a great precedent for what could happen in the future as surprises and macro events shake things up.

While DG does present a better ‘value’ and the company is larger in scope – which does offer some advantages – DLTR’s premium brand, better execution, and stronger relative outlook make us think that the stock will outperform DG in the long term.

We rate DLTR a “Buy” and DG a “Hold” as a result of this relative analysis.

Cheers!

Read the full article here