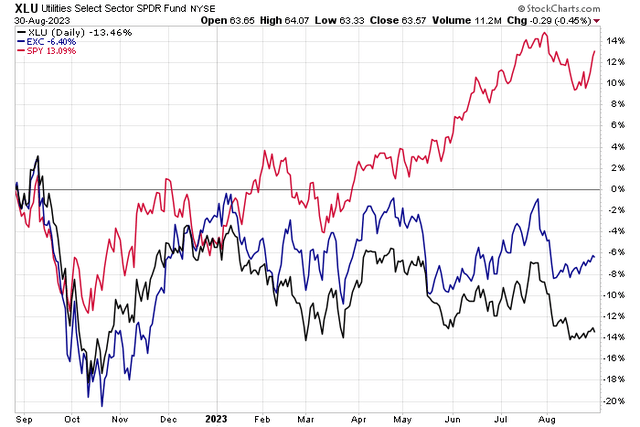

The Utilities sector has been one of the worst-performing areas of the market over the past year. Recall it was September 2022 when the XLU Utilities Sector SPDR plunged as interest rates surged. While the fund found a low the following October, its rebound rally petered out in January, and XLU is now sharply underperforming the S&P 500.

I have a buy rating on Exelon Corporation (NASDAQ:EXC) for its favorable growth outlook and strong yield, though I recognize risks on the chart.

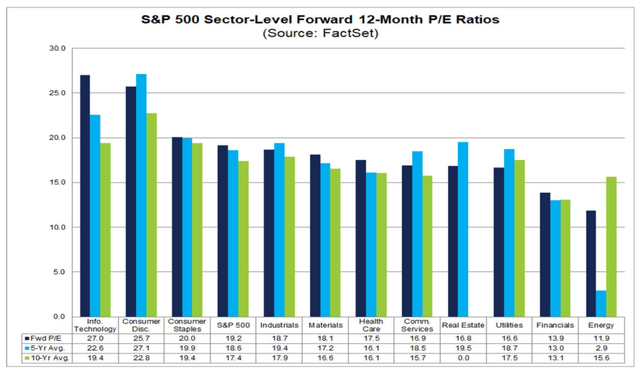

Utilities Now Cheap On A P/E Basis Vs SPX

FactSet

1-Year Total Returns: EXC Beats XLU, But Both Lag SPY

StockCharts.com

According to Bank of America Global Research, Exelon Corp is predominately a transmission & distribution (T&D) electric utility (85%) firm operating in Illinois, Pennsylvania, Maryland, Washington D.C., New Jersey, and Delaware. Primary utilities include Commonwealth Edison (ComEd) in IL, PECO Energy Company (PECO) in PA, PEPCO in MD/DC, Baltimore Gas & Electric (BGE) in MD, Atlantic City Electric (ACE) in NJ, and Delmarva Power (DPL) in DE/MD. Exelon is the largest public regulated utility by customers (10.5Mn+).

The Chicago-based $40.2 billion market cap Electric Utilities industry company within the Utilities sector trades at a near-market 18.9 trailing 12-month GAAP price-to-earnings ratio and pays a high 3.6% dividend yield. With earnings not until early November, shares trade with a low implied volatility percentage of just 15.8%, while short interest is also modest at 1.2% as of August 30, 2023.

EXC sports solid long-term earnings growth in the mid-single digits with an above-market yield. Back in early August, Exelon reported a small earnings beat with $0.41 of EPS, a penny better than estimates, while revenue verified at $4.8 billion, a 13% jump from year-ago levels. The management team reaffirmed 2023 adjusted operating earnings guidance in the range of $2.30 to $2.42 with a 6-8% fully regulated operating EPS growth rate target through 2025 and 2026. Strong performance at units serving customers in Illinois and Maryland supported the robust quarter, and it is possible that a very hot summer with limited disruptions could result in high Q3 earnings to come.

Also, in a recent Illinois rate case, key intervenors like the Illinois Commerce Commission (ICC) Staff and Citizens Utility Board (CUB) recommended an 8.9% return on equity and a 50% equity ratio, differing from ComEd’s requested 10.5% ROE and 50.6% equity ratio. The staff’s 5% proposed rate CAGR for 2024-2027 is lower than the management’s 7% request, but still seen as positive. So, everything appears on track there, but a key risk is the firm’s FFO/debt rate near 13%, thus higher interest rates could hurt the company, though debt levels are seen as coming down in the coming quarters, helping to assuage risks of an equity capital raise. Of course, unfavorable regulatory outcomes, natural disasters, rising operating costs, and fluctuations in tax levels are seen. Just recently, Barclays issued an ‘overweight’ recommendation on EXC.

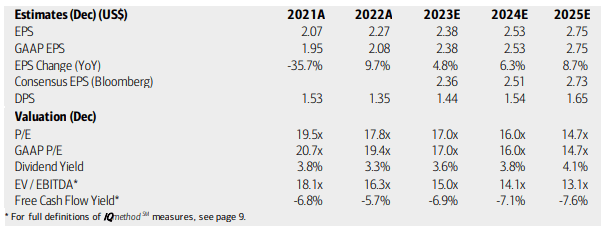

On valuation, analysts at BofA see earnings climbing at an accelerating pace through 2025. Per-share profits are expected to approach $2.75 in the out years, and the Bloomberg consensus forecast is about in line with what BofA projects. Dividends, meanwhile, are expected to rise at a comparable rate over the coming quarters. Shares now trade at a slight discount to the market’s forward operating P/E, but also modestly above the ratio on the broad sector.

Exelon: Earnings, Valuation, Dividend Yield Forecasts

BofA Global Research

Looking closer at the valuation, if we assume $2.45 of normalized forward EPS and apply the sector median multiple of 17.1, then shares should be near $41. I assert, though, that with steady and solid earnings growth and a high yield, a slight valuation premium is deserved. Its low-risk profile is another reason to pay up for the stock. So, a 19 multiple would put the stock near $46.

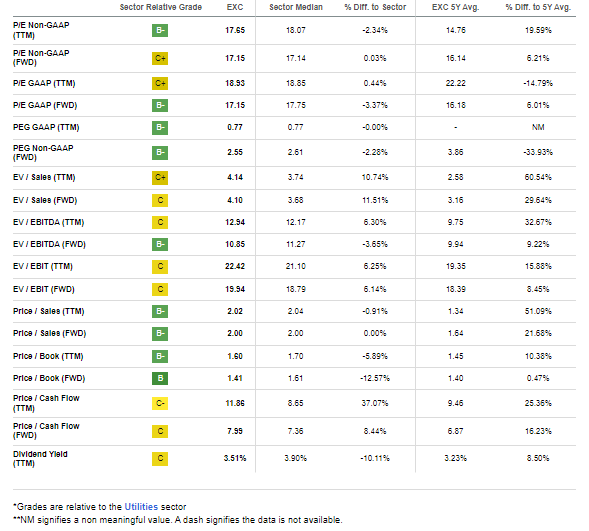

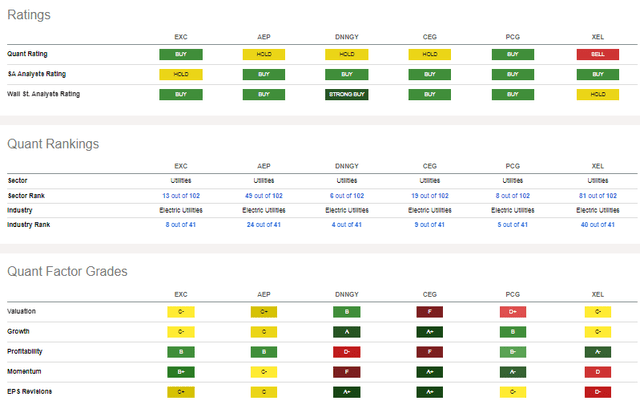

EXC: Neutral Valuation Ratings, But Steady EPS Growth Should Be Viewed Positively

Seeking Alpha

Compared to its peers, EXC features a lukewarm valuation grade but relatively strong profitability and strong momentum, and I contend that the growth rating undercuts its true value and modest risk situation.

Peer Comparison

Seeking Alpha

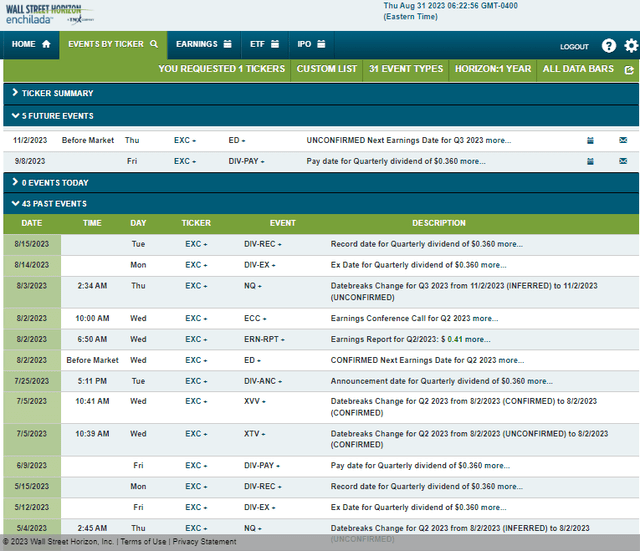

Looking ahead, corporate event data provided by Wall Street Horizon show an unconfirmed Q3 2023 earnings date of Thursday, November 2 BMO. No other volatility catalysts are expected.

Corporate Event Risk Calendar

Wall Street Horizon

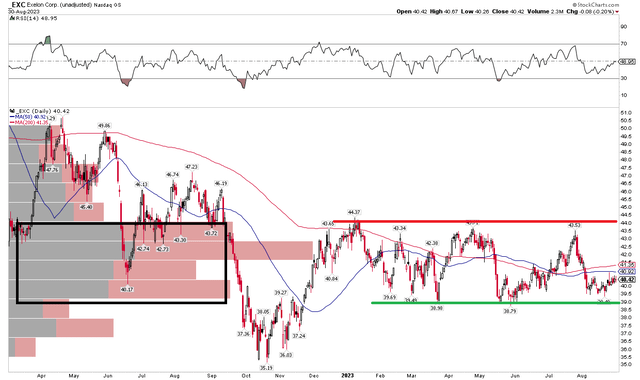

The Technical Take

Since I first reviewed EXC, shares have underperformed. Admittedly, my strong buy rating was too optimistic. The sector has not performed well compared to the broader market, but shares are not down terribly since August last year on a total return basis.

Today, EXC’s chart is not all impressive, though. Notice in the graph below that shares are stuck in a trading range, with support in the $38.80 to $39.70 range and resistance seen just under $45. This is the primary feature that must be monitored as a bullish breakout would suggest an upside measured move price objective to just above $50 – near the April highs from last year, while a bearish breakdown could leave EXC susceptible to a drop to fresh lows not far from $30.

Making this range all the more important is a high amount of volume by price in the $39 to $44 zone – so expect the battle to persist. I do like that the long-term 200-day moving average has turned slightly up in its slope, but I would like to see the shorter-term 50-day moving average rise above the 200dma to help confirm a rising near-term trend, which could then turn into a longer-term upward move. For now, it is a hold on technicals.

EXC: Emerging Trading Range

Stockcharts.com

The Bottom Line

I have a buy rating on EXC. I still like its growth outlook and risk profile, and view the valuation as to the good side. Meanwhile, a high yield is there for the taking, but would like to see the technicals and momentum improve.

Read the full article here