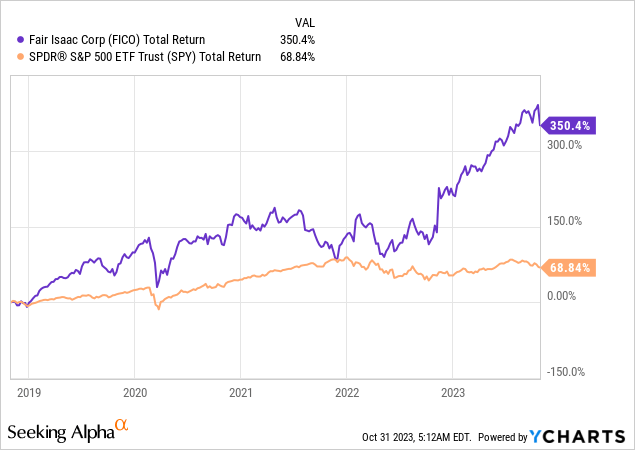

There are many reasons to sell a stock or avoid investing in one, but I believe selling because “it has gone up too much” is not a valid reason as long as nothing has changed relative to the initial investment thesis.

I had made this mistake for some years before realizing there are not many companies with a clear and strong competitive advantage, pricing power, high returns on capital, and good capital allocation, and it is worth it to let them compound despite they can look expensive from time to time.

Fair Isaac Corporation (NYSE:FICO) is a company that almost always seems expensive, but the premium could be justified.

Investment Thesis

FICO enjoys a government-blessed monopoly on a highly scalable business model with pricing power. The company has been selectively increasing its score prices in recent years and still has room to grow since the cost of a FICO score is less than 0.15% of the total expenses for a consumer in a mortgage origination process.

In the software segment, the transition from a license model to a cloud-based subscription model has accelerated its revenue growth and margins.

FICO has robust Free Cash Flows (FCF) and high returns on invested capital due to its asset-light business model. The company is led by highly skilled management with high skin in the game and an appropriate compensation structure, which returns the profits to shareholders by reducing the shares outstanding.

Company Overview

FICO is a leading analytics software company that developed the algorithm for the FICO score, a three-digit number between 300 and 850 introduced in 1989 which is currently the standard measure of consumer credit risk in the United States. Due to FICO scores being mandatory when conforming mortgages delivered to Freddie Mac and Fannie, FICO holds an unrivaled 90% market share in consumer credit scores.

The company also offers software solutions for business customers and is moving from a series of standalone solutions to an integrated, cloud-based platform with higher margins.

Since 2018, FICO has been increasing its growth rates significantly by raising prices in the scores segment and transitioning to a cloud-based platform, enhancing its profitability.

Its market cap has maintained a remarkable 35% Compound Annual Growth Rate (CAGR) over the past five years, exceeding $21 billion.

Business Model

FICO generates its revenues from licensing its credit scoring models to the credit bureaus and by providing analytics software and tools used across multiple industries to support decision-making at scale.

The business model is highly scalable. When FICO has invested in developing its mathematical algorithms and predictive analytics software, the marginal cost is close to zero, with incremental operating margins.

It operates under two business segments: scores and software.

Author

Scores

The FICO Score is the most known product of the company. Its algorithm is applied to data collected and maintained by the three U.S. national consumer reporting agencies -Experian (OTCQX:EXPGF), TransUnion (TRU), and Equifax (EFX)- to produce standard scores and assess consumer creditworthiness.

As many assume, FICO does not maintain a database of FICO scores but provides the credit bureaus with software containing an algorithm. When a lender requests a credit rating, the score is generated by one of the national credit bureaus.

Consumers can purchase their scores from the myFICO.com website, but the majority of the revenues are generated on a B2B basis and the three major bureaus accounted for 39% of total revenues.

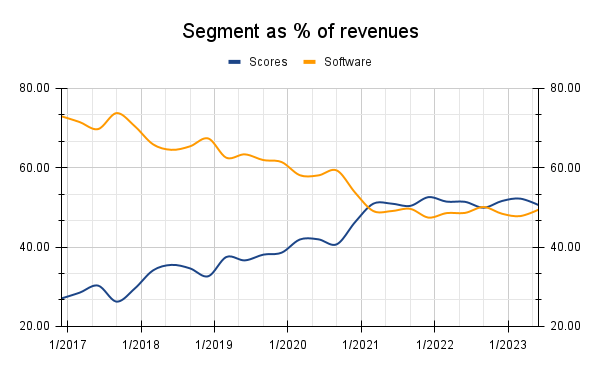

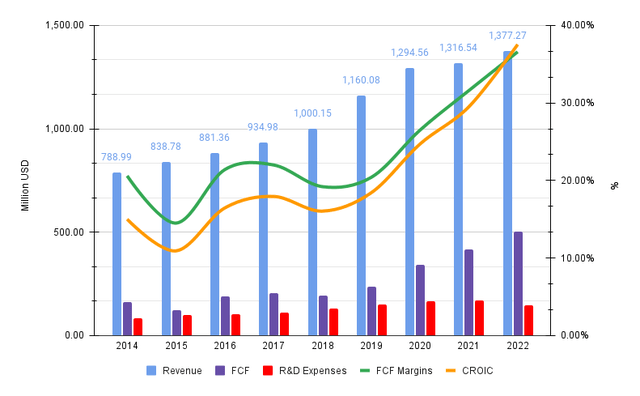

Scores is the most profitable segment and already represents over half of FICO’s revenues. As shown in the image above, it wasn’t always like this. Since 2018, FICO started to bring the price up on this segment to capture more value from the lending process, after 25 years of frozen prices.

The company charges a fee per score depending on the clients’ volume. The price increases have been gradual, starting with mortgage originations in 2018, auto loans in 2019, and cards and personal loans in the following years.

Management didn’t just increase its score revenue by 17% CAGR over the last 5 years but also increased operating margins from 77% in 2017 to 88% during 2023 given that the marginal cost for a new score is zero.

Software

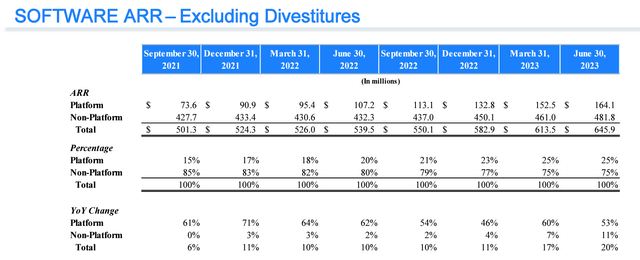

The software segment is not falling behind and has been increasing its operating margins from less than 20% in 2019 to over 35% in the last quarter by transitioning from its license model to the FICO Platform, which has seen 15 straight quarters with revenues growing over 40%.

FICO provides its clients, mainly financial institutions, with analytic and decision software tools that enable them to:

- Optimize consumer engagement

- Fraud detection

- Risk management

- Supply chain management

- Predictive modeling

- Decision analysis

Despite the slowdown in the macroeconomic environment for many industries, FICO’s Software segment has been growing due to its mission-critical nature.

FICO 3Q 2023 Presentation

The investment over many years into the FICO Platform is paying off, and revenues have more than doubled in two years. Operating margins will continue to increase as the FICO Platform represents a higher percentage of the software revenues.

Competitive Advantage

FICO has a wide competitive advantage in the score segment. The FICO scores are an industry standard, and this was reaffirmed last year by the Federal Housing Finance Agency (FHFA) which announced that FICO Score 10T will be required to be used for each conforming mortgage delivered to Freddie Mac and Fannie Mae along with VantageScore 4.0.

Despite the introduction of the VantageScore by the credit bureaus in 2006, FICO is still the most used credit score, with over 90% market share. Even lenders that don’t use it as a criteria for lending, need to provide the score since financial institutions use FICO scores as a means of communicating the credit quality of a loan portfolio for investors.

One reason for this competitive advantage in the score segment is that regulators need to set an industry standard to make sure the credit ecosystem runs as smoothly as possible. FICO has been providing its scores for over 40 years and unlike VantageScore, it is independent.

Also, the price for a FICO Score, despite the increases, is still minuscule when compared to the total cost of a credit application, disincentivizing its clients from switching to a less reliable or unknown provider, given the risks associated.

Kind of a $2 to $8 range is what FICO gets from a mortgage to completion, and that’s out of $50 or more of credit-related fees. It’s out of $3,800 of closing fees to a consumer. So when you measure the FICO mortgage score in single-digit dollars against kind of the greater cost here as you see it in perspective.

(Source: William Lansing, Barclays 2022 Global Technology, Media and Telecommunications Conference)

In the software segment, the competitive advantage is not that obvious and doesn’t come from regulations, but I believe FICO provides its services in a sticky business segment and has an unmatched advantage against its competitors. The company has been developing its predictive modeling tools for over 60 years and currently holds 188 patents in the U.S., 20 foreign patents, and 83 pending.

FICO operates in different software niches such as advanced analytics, decision modeling, fraud detection, and customer engagement among many others. When a client purchases FICO’s software, it is unlikely it will quit, since it requires special configuration and training (which FICO provides through its Professional Services).

The software FICO provides is mission-critical, highly adaptable, and provides great value relative to its price, which is usually small when compared to the overall expenses of FICO’s clients.

Relatively to its competitors such as Nice Actimize, Experian, or Pegasystems Inc. (PEGA), FICO has the advantage that it enjoys the cash flows from the scores segment, enhancing its R&D capabilities (11% of revenues).

Finally, FICO provides its services to all the top 10 Fortune 500 companies and 75% of the largest 100 global banks, which provides highly valuable data flow to improve its products by leveraging the advances in artificial intelligence and machine learning, where FICO already holds over 200 patents.

This fact reminds me of Alphabet’s (NASDAQ:GOOG, NASDAQ:GOOGL), competitive advantage in the search engine space. By having the best search engine, they get more users and the data to improve the product even more, increasing the distance to its competitors.

FICO August 2023 Investor Presentation

Financials

Because of FICO’s asset-light business model, it has enjoyed high returns on capital for a long time, but by bringing to fruition its pricing power and competitive advantage, FCF Margins and CROIC have increased to over 30%.

Author (Data from Annual Reports)

Note: CROIC has been calculated as Free Cash Flow divided by the average invested capital over the year.

Despite the unfavorable macroeconomic environment and the decline in mortgage originations, FICO has shown its pricing power by increasing its prices at faster rates than the increase in expenses by reducing its workforce and consolidating office space. It also sold the Collections and Recovery business to Constellation Software (OTCPK:CNSWF, CSU:CA) in 2021, which represented less than 10% of revenues, to focus on the Decision Management software.

Regarding its balance sheet, FICO has a net debt of $1.8B, which is 3.3x its expected FCF for 2023, and negative equity because of its aggressive share buybacks. The net debt ratio is at reasonable levels, but I expect it to decline in the next quarters since the management opportunistically used debt to repurchase over 10% of shares outstanding during 2022 when the stock was trading in the 400-500 range.

Of the $1.8B of debt, $1.3B are Senior Notes at fixed interest rates maturing in 2026 and 2028 ($0.9B at 4% and $0.4B at 5.25%), and the rest are withdrawn from the line of credit and term-loans with variable interest rates, which are currently at 6.8% (3Q 2023).

Since FICO can’t reinvest most of its FCF into the business due to its asset-light nature, the company is returning its FCF to shareholders through share buybacks and has no dividends, which I believe is a top-notch capital allocation, especially when management is taking into account valuation multiples.

During the last 10 years, FICO has reduced its shares outstanding by almost 30% from 36.21MM to 25.44MM.

Management

Since 2012, William J. Lansing (Age 64) has been the CEO of FICO and has been on the Board of Directors since 2006. His outstanding leadership has created huge value for FICO’s shareholders and the stock has increased over 20x.

The board of directors has 7 non-employee members plus Mr. Lansing. Non-employee directors receive on average ~$320,000 per year, mainly from stock and option awards.

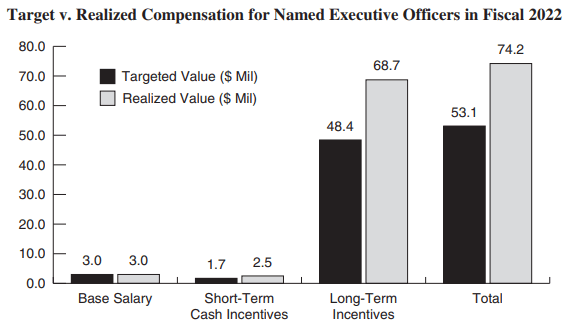

To align executive officers’ interests with the creation of stockholder value, the long-term equity incentive compensation represents a large majority of their target total direct compensation opportunity.

FICO 2023 Proxy Statement

The CEO of the company has the highest base salary with $750,000, which I consider to be modest given the size of the company, and most of his compensation is based on long-term equity incentives.

One-third of long-term equity incentives are time-based vested over 4 years, and the other two-thirds are performance-based taking into account Adjusted Revenues, Adjusted EBITDA, and stock overperformance relative to the Russell 3000.

Even though I usually don’t like adjusted figures and EBITDA, in FICO’s case makes sense for me because of divestitures and because EBITDA figures don’t differ much from final net income and FCF figures. It will be important to track how the management uses debt and make sure interest expenses don’t increase too much, up until now, management has been using debt perfectly so I have no reason to think about mismanagement.

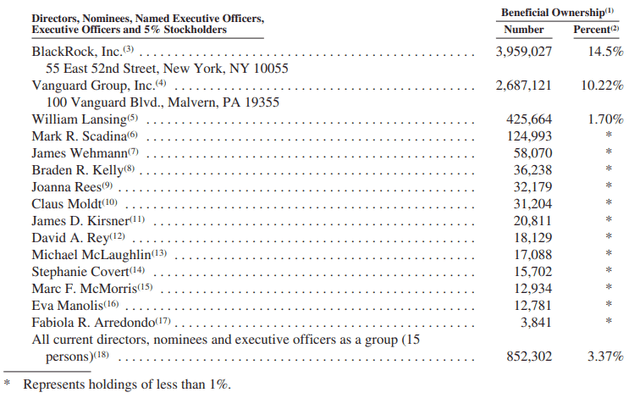

Stock ownership requirements are at least 100,000 shares for the CEO (~$92MM at current prices) and five times the base salary for Executive Vice Presidents. The management combined owns 3.37% of the company (~$784MM), which is 10x its total compensation.

FICO 2023 Proxy Statement

Overall, I like the compensation structure, and the fact that the CEO owns over 4x the minimum requirement inspires great confidence.

To be fair and mention some negative aspects, it is important to note that James Wehmann (Executive Vice President, Scores), has been selling 2,836 shares during the year. It is not much compared to his total ownership and I have no further information, it might be he believes the stock is overvalued, or simply prefers to take some chips out of the table for other reasons.

From a performance point of view, the management has done an outstanding job in my opinion because of these reasons:

- Successfully increased prices on the score segment

- Education programs to improve credit awareness

- Margin increase on software segment and cloud transition

- Strategic cost initiative implementation

- Long-term perspective

- Conservative guidance

- Opportunistic buybacks

Expectations and Valuation

Management never discloses how much revenue growth is because of price increases and how much because of increasing demand, but they have already stated that there will be further price increases in the score segment over the years.

I think that you can expect continued growth in Scores in both contribution from price and contribution from higher volumes that we anticipate next year.

(Source: William Lansing, Q3 2023 Earnings Call)

Even with the sharp decrease in mortgage and loan originations from the end of 2021, FICO has been increasing Scores revenues by 8% annually, so I expect this rate to accelerate in a more favorable macroeconomic environment to at least 12% annual growth.

On the software segment, FICO is gaining momentum and during the last quarter delivered a 20% YoY growth in revenues as the FICO Platform represents a higher percentage of revenues.

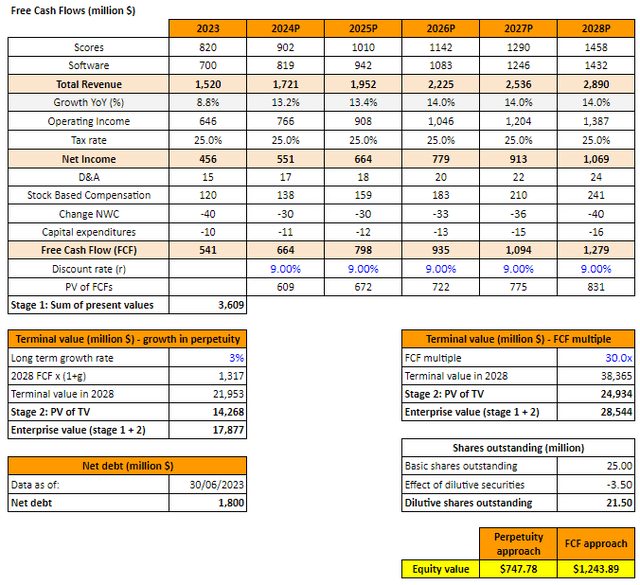

During the following years, I expect FICO’s revenues to grow at low double digits due to a recovery in loan originations and price increases above inflation. As the FICO Platform grows in revenues, FCF margins should increase to 44% in 2028.

Author

I used a 9% discount rate, based on FICO’s 1.17 beta (5-year average) and a 5% cost of debt, with a 3% long-term growth rate based on inflation and a 30x last twelve months FCF multiple, which is lower than recent valuation but as price increases slowly its pace I expect it to go down to this level.

With a 3% yearly decrease in outstanding shares, the current average fair price in my base case scenario is $995 and I expect 14% returns CAGR over the next 5 years taking into account a decrease in valuation multiple.

In a more conservative scenario with revenue growth rates at 10% and FCF margins at 42% in 2028, the current fair price would be $800.

TIKR.com

FICO is currently trading at 33x its next twelve months expected FCF, which I believe is a fair valuation given the quality of the business, the experienced management, and its high growth rates not showing any signs of declining soon.

Risks

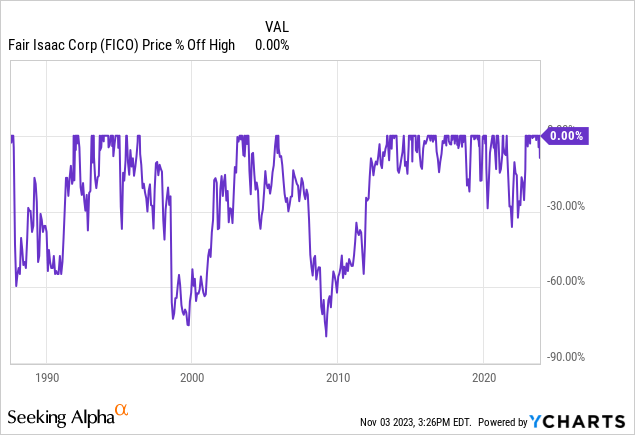

FICO has successfully overcome many bear markets over its long history as a publicly traded company but with some significant drawdowns along the way, especially during the Great Financial Crisis in 2007-2008.

Despite the 80% drawdown during the GFC, the company decreased its revenues by less than 25% from its peak in 2007 to its low in 2010 and continued to generate profits, which decreased by 38% during the same period.

From a business perspective, this is an incredible performance during the worst financial crisis we had in modern times, given that 90% of its clients are financial institutions, and taking into account that the business has changed significantly since then (net income margins were 12.6% in 2007 compared to 27.1% during 2022). Despite its exposure to financial institution clients, an economic downturn is not the major risk I see in owning FICO.

The major risk I see in FICO’s business is the withdrawal by the FHFA, Freddie Mac, and Fannie Mae of its monopolistic position in the scores segment. If the FICO Score is not required anymore it would have a significant negative impact on the revenues and margins of this segment.

From a financial perspective, I don’t see any major risk since most of its debt is at fixed interest rates, maturing long-term, and the company has a strong FCF to reduce its debt in the expenses of share buybacks.

Conclusion

FICO is one of these unique businesses hard to find, with a monopolistic position in a highly profitable business segment with incremental margins.

On top of that, the company is transitioning its software segment from a license business model to a cloud-based subscription model with increasing margins.

In a base case scenario, I consider the stock slightly undervalued and my fair price is $995 per share, expecting a 14% CAGR return over the next years.

Despite many analysts and investors arguing that the valuation is high, and maybe they are right in waiting for a price decline, I prefer to own the best business models, which I believe FICO is, that look for a cheap valuation in a mediocre company.

Read the full article here