Golub Capital BDC Inc. (NASDAQ:GBDC) is selling for a reasonable 8% premium to net asset value considering the strength of the business development company’s underlying excess dividend coverage and adjusted net investment income growth.

Golub Capital BDC paid out only 84% of its adjusted net investment income in the last year and has consistently distributed excess portfolio income as special dividends. I think that the 8% for Golub Capital is reasonable considering that the business development company is comfortably covering its dividend (both regular and special) with NII.

The business development company also just announced a merger with another BDC which is poised to improve Golub Capital BDC’s scale and fee structure.

My Rating History

In February I maintained my Hold stock classification for Golub Capital BDC due to the potential for declining net investment income in a falling-rate environment.

Inflation has most recently proven to stubbornly hold above 3% which, in the short-term, should continue to benefit Golub Capital’s large floating-rate portfolio. In the medium, or long-term, Golub Capital BDC is probably going to see slower net investment income growth, or maybe even negative growth in this key metrics if the central bank starts to lower short-term interest rates (which I anticipate will happen towards the end of this year).

Portfolio Review And Merger With Private BDC Golub Capital BDC 3

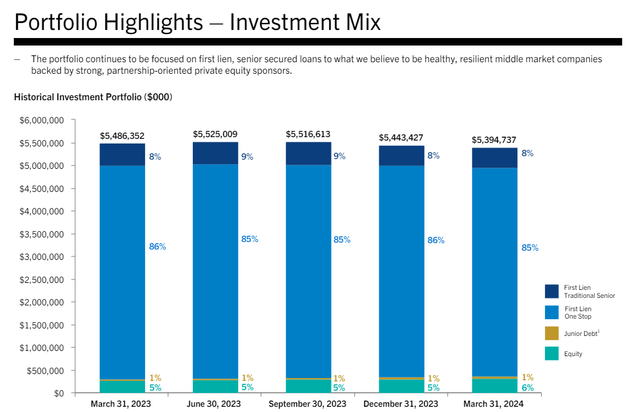

Golub Capital BDC is a First Lien-centric business development company with a $5.4 billion investment portfolio. The BDC is 93% First Lien with the remaining 7% consisting mainly of Equity (6%) and Junior Debt (1%).

The business development company’s portfolio value shrank by $49 million in the last quarter, however, as investments exited and repayments exceeded the BDC’s new investment commitments. With that being said, in terms of market value, Golub Capital BDC is the 7th biggest business development company in the sector.

Portfolio Highlights – Investment Mix (Golub Capital BDC)

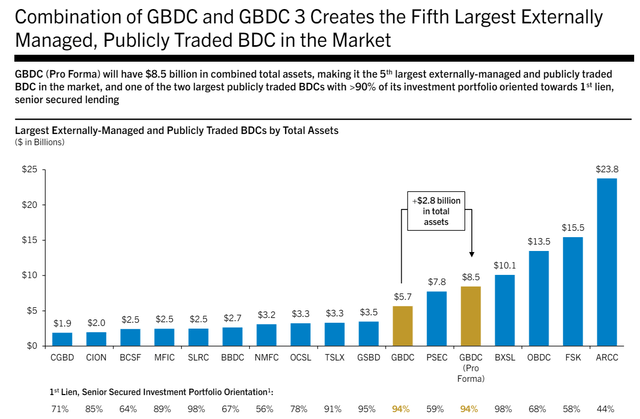

Golub Capital BDC announced in May that it will merge with Golub Capital 3, a private BDC that has been managed by an affiliate of Golub Capital. The transaction would create the fifth-biggest (externally-managed BDC) with approximately $8.5 billion in investment assets.

Merger Overview Of Total Assets (Golub Capital BDC)

Golub Capital will not only become a bigger BDC with improved trading liquidity but will also remain focused on high-quality First Liens (approximately 93-94% of investments will be First Liens).

A key advantage of the merger is that the BDC will permanently lower (upon merger closure) its incentive fee for capital gains, from 20% to 15% which represents a catalyst for shareholders of Golub Capital BDC.

Furthermore, Golub Capital BDC anticipates that the merger will lower its operating expenses by 6% annually, due to elimination of duplicate corporate functions, which is poised to lead to an estimated $1.2 million run-rate cost savings per annum.

Robust Dividend Coverage Supports Special Distributions (Even Before Incentive Fee Reduction)

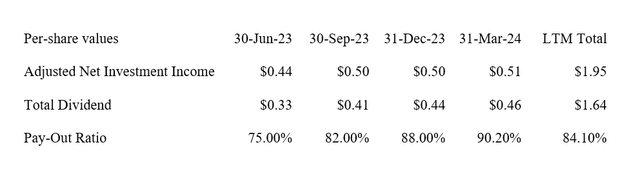

In the last year Golub Capital BDC has emerged as one of the strongest income growth plays in my passive income portfolio as the company distributed excess portfolio income to shareholders via hikes in the regular dividend and paid special dividends. In the most recent quarter, 2Q24, Golub Capital BDC raised its regular dividend to $0.39 per share and the business development company paid a special dividend in the amount of $0.07 per share. Based on a 2Q24 annualized dividend pay-out of $0.46 per share per quarter, an investment in Golub Capital yields a very healthy 11% which obviously makes GBDC a compelling investment vehicle for those investors that look for recurring passive income.

All dividend payments considered (regular and special), Golub Capital BDC paid out 90% of its adjusted net investment income in the last quarter, up 2 percentage points QoQ.

In the last twelve months, Golub Capital BDC paid out only 84% of its adjusted net investment income, suggesting that passive income investors don’t have to worry about the BDC’s dividend coverage in 2024, particularly as long as the central bank doesn’t move short-term interest rates.

Dividend (Author Created Table Using BDC Information)

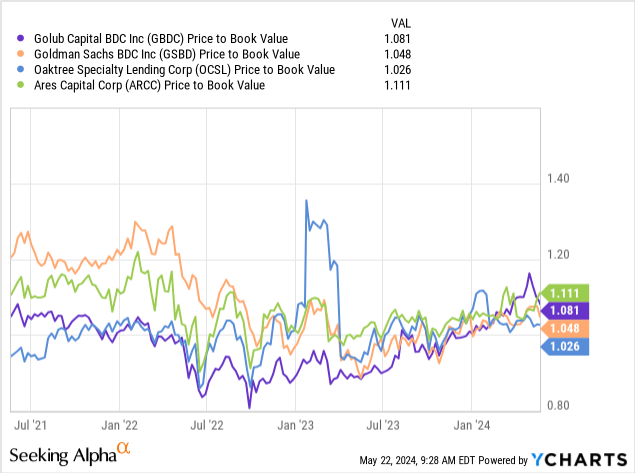

Golub Capital BDC Sells For A Premium To NAV

Given the high quality of Golub Capital BDC’s portfolio structure (which is dominated by First Liens) and the BDC’s high degree of excess dividend coverage as well as special dividend potential, I think the 1.08x NAV valuation remains very sensible.

Other business development companies in the sector including Goldman Sachs BDC Inc. (GSBD), Oaktree Specialty Lending Corp (OCSL) and Ares Capital Corp. (ARCC), also trade at small premiums to net asset value, so I don’t think that Golub Capital BDC stands out, particularly with its valuation multiple.

What I am saying though, is that Golub Capital has considerable special dividend potential in 2024 due to its aggressive floating-rate posture: Approximately 99% of the BDC’s investments have been funneled into floating-rate First Liens in the past which is now paying handsome dividends for passive income investors.

Why Passive Income Investors Could Be Disappointed

The inflation trajectory indicates that consumer prices are still rising and proving to hold up above 3% which delays the central bank’s rate cut timeline. This has benefited business development companies with large, floating-rate heavy-debt investment portfolios, like Golub Capital BDC.

In the long-term, however, passive income investors should anticipate much less powerful tailwinds for the BDC’s adjusted net investment income which has made recent dividend hikes possible. Put simply, lower short-term interest rates will probably diminish Golub Capital BDC’s special dividend potential.

My Conclusion

Golub Capital BDC is a well-managed business development company that I like specifically for three reasons:

- The BDC is still overwhelmingly focused on floating-rate loans that throw off more net investment income if the central bank doesn’t cut short-term interest rates quickly.

- Golub Capital BDC is focused on high-quality First Liens and the merger with GOLUB CAPITAL BDC 3 will lead to a more diversified BDC with a more efficient cost structure.

- Third, Golub Capital BDC is solidly earning its regular dividend as well as its special dividends which help make a strong value proposition for passive income investors that rely on regular, quarterly dividend paychecks from their BDC investments.

Read the full article here