By Carsten Brzeski, Global Head of Macro and James Smith, Developed Markets Economist

Central bank rates are reaching their peak globally, and we’re already starting to see rate cuts in certain regions. Here’s what our team expects from policymakers across the world over the next few months.

Macrobond, ING

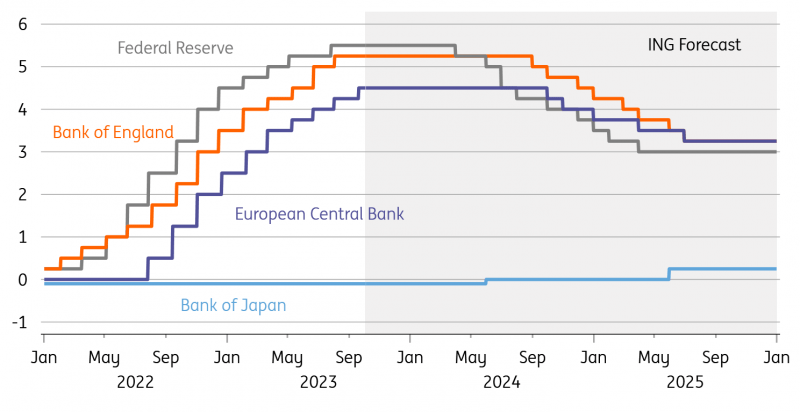

Federal Reserve

Our call: No further rate hikes with cuts starting from Spring 2024

Rationale: The Federal Reserve continues to signal the potential for a further rate hike this year, given that inflation remains above target, the jobs market is tight and activity has proven to be surprisingly resilient. Nonetheless, challenges will continue to mount, with real household disposable income slowing to a crawl just as student loan repayments are restarting, credit availability is drying up and pandemic-era accrued savings are being exhausted for many households. Encouragingly, key inflation measures are looking more benign, with the core personal consumer expenditure deflator posting three consecutive 0.2% or below month-on-month prints. Assuming this continues, the Fed will have the flexibility to respond to the slowdown in the economy we expect to see in 2024.

Risk to our call: A tight labour market and a US consumer that continues to spend could keep inflation higher for longer, especially if unions extract inflation-busting wage agreements that set a benchmark for broader pay deals. The Fed would have little hesitation in hiking further in this scenario. Alternatively, if financial distress re-emerges in the banking sector – most likely via the commercial real estate market – this will tighten lending conditions markedly and could prompt the Fed to cut interest rates more aggressively.

European Central Bank

Our call: No further rate hikes and the first rate cut in summer 2024

Rationale: Official European Central Bank (ECB) comments since the September meeting and rate hike suggest that the ECB is not done yet with its hiking cycle. However, we expect the eurozone economy to weaken further and faster than the ECB currently expects. Combined with more disinflation until the end of the year, there will be very few arguments in favour of further rate hikes at the late October and early December meetings. Once the Fed starts cutting rates, and assuming eurozone inflation remains around 3% next year, the ECB will be in a position to alter its monetary policy stance to one that is less restrictive but not yet accommodative.

Risk to our call: A more resilient eurozone economy coupled with the impact of the recent oil price surge could easily push the ECB to opt for at least one more hike before year-end. The ECB is clearly also concerned with its own inflation-fighting credibility and the fear of a de-anchoring of inflation expectations. The ECB’s very own dismal track record in predicting inflation could tilt the balance towards more hikes.

Bank of England

Our call: No more rate hikes and the first rate cuts from summer 2024

Rationale: The Bank of England (BoE) held rates steady at its September meeting, and there’s not a huge amount of data set to be released between now and the next decision in November which is likely to alter that calculation. Barring a big spike in services inflation or wage growth, we think the tightening cycle has finished. The BoE has been very clear that it is prioritising keeping rates higher for longer over hiking more aggressively in the short term. Still, with unemployment rising, it’s only a matter of time before wage growth starts coming down, though progress is likely to be gradual. Come next summer, the average rate on outstanding mortgage debt is likely to have gone from 3% now to over 4%, even without any more hikes. That suggests a gradual rate-cutting cycle can start from the middle of next year, taking rates to something closer to neutral.

Risk to our call: Large upside surprises to services inflation or wage growth unlocks another rate hike in November.

Bank of Japan

Our call: Another tweak to the Yield Curve Control (YCC) policy but no change in the policy rate until the second quarter of 2024

Rationale: Recent data has shown inflation is proving to be more stable and sticky than expected. There are signs that some of it reflects demand pressure, with private service prices rising notably in recent months, helped by rising tourism. An additional nudge from monetary policy would also provide some support for the JPY, which has been under pressure given the higher for longer market view of the Fed. A change to policy interest rates will not happen earlier than we are forecasting because the Bank of Japan (BoJ) will need to see the outcome of the Spring Wage settlement in order to be convinced that the economy can withstand interest rate normalisation.

Risk to our call: Despite evidence to the contrary on inflation and wages, the BoJ seems extremely nervous about departing from its current approach and may stick with it for longer.

Macrobond, ING

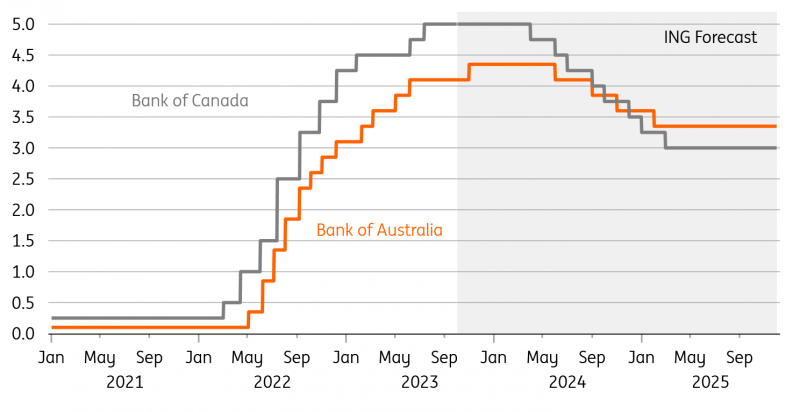

Bank of Canada

Our call: No further rate increases with rate cuts from the second quarter onwards

Rationale: The economy posted a surprise contraction in the second quarter, and since then activity has flat-lined with wildfires, floods, and strike action all acting as a brake on activity in addition to the cumulative effects of policy tightening from the Bank of Canada (BoC). Inflation is proving to be sticky and unemployment remains low, so the BoC has held the door ajar for a potential further hike – although we are not expecting one to materialise. With an increasing number of households facing mortgage rate resets at much higher borrowing rates, there is a concern that highly indebted households will feel intensifying pain over coming quarters. Economic weakness will also contribute to inflation gradually slowing to target, thereby allowing the BoC to cut rates from the second quarter onwards.

Risk to our call: The BoC has been prepared to pause and restart once already this year and will not be averse to repeating should inflation fail to slow as we expect.

Reserve Bank of Australia

Our call: One more hike to the cash rate, possibly in November or December

Rationale: The macroeconomy remains reasonably robust, housing rentals are still growing, and inflation is rising again. While much of this is due to the end of favourable base effects and external factors such as oil prices, the ongoing run rate for inflation remains higher than is consistent with the Reserve Bank of Australia (RBA) meeting their 2-3% inflation target. The new governor, Michele Bullock, may also wish to signal her inflation-fighting credentials to the market. By November, we will have the third-quarter inflation numbers for the RBA to ponder. The December meeting provides another opportunity to consider a final hike. Thereafter, if rates have not been raised, they will probably not be raised again this cycle as base effects should once more help to bring inflation lower again.

Risk to our call: The market does not believe that the RBA will hike again, and they may shrug off recent inflation increases given that they are not looking to hit their inflation target until 2025 anyway.

Remainder of G10 central bank forecasts

Macrobond, ING

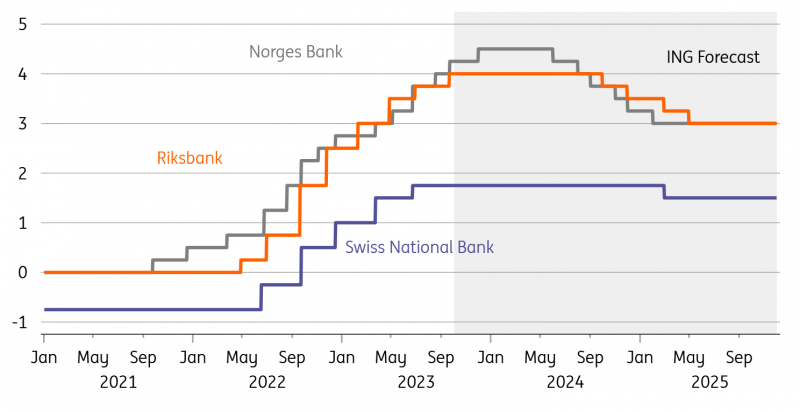

Riksbank

Our call: No more rate hikes and cuts begin at a similar time to the ECB

Rationale: Calling whether or not the Riksbank will hike again in November is a closer call than with some other central banks. The September rate projections pointed to a 40% chance of another hike. The economy is clearly vulnerable, and Sweden’s housing market is among the most readily exposed to higher rates. We’ve already seen a sharp fall in prices, though more recently the situation has stabilised. The jobs market remains resilient for now, and the Riksbank is acutely aware that services inflation is still way too high. Whether or not we get another hike will depend on the currency. A return to the lows on a trade-weighted basis would concern Riksbank hawks – not least the governor who has been vocal about the risks of FX weakness.

Risk to our call: Renewed SEK weakness prompts one more hike later this year.

Norges Bank

Our call: One final rate hike in December

Rationale: Unlike many of its peers, Norges Bank has stated its intentions to hike again later this year. That reflects a wariness about the recent rise in oil prices, as well as the sell-off in developed market government bonds recently. A December rate hike is therefore our base case, as there’s little reason to doubt what Norges Bank is telling us. But it’s likely to be the last, barring a big upside surprise in oil prices over the coming months or a further bout of NOK weakness.

Risk to our call: Further oil price spikes require more tightening than Norges Bank has recently signalled.

Swiss National Bank

Our call: No more rate hikes but the SNB will continue to sell foreign currency

Rationale: At its last meeting, the Swiss National Bank (SNB) was rather dovish, deciding to pause its tightening cycle while at the same time revising down its inflation outlook for the next few years. The fact that inflation has been below 2% for the past three months has encouraged this view. While inflation is likely to rise temporarily above 2% in the next few months, it should then fall again. The SNB will probably continue to make extensive use of its foreign exchange reserves to strengthen the Swiss franc to limit inflationary pressures in the months ahead. We believe that the rate hike cycle has come to an end and that the SNB will keep its rate at 1.75% for the next few quarters. A rate cut is likely in 2025, which would take the key rate to 1.5%.

Risk to our call: If inflation rises too sharply in the coming months and the global economic environment is better than expected, the SNB could be tempted to go further than selling foreign currency and raise its rate again in December 2023.

CEE central bank forecasts

Macrobond, ING

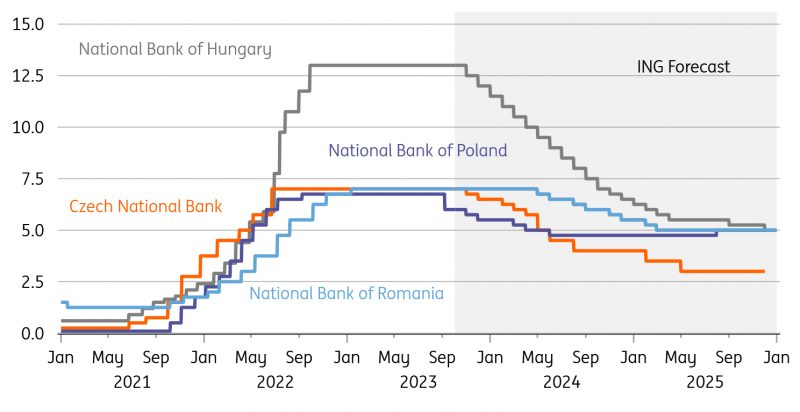

National Bank of Hungary

Our call: Cautious easing with two 25bp cuts over the next couple of months

Rationale: According to our forecast, September headline inflation could be around 12.4%, clearly closing the door to a 75bp or a 100bp easing should the National Bank of Hungary (NBH) see a positive real interest rate (ex-post) after its October decision. What could also be a factor here is the EUR/HUF level and volatility. A lower-than-expected CPI print might reignite some dovish expectations, and as the NBH reaction function contains market stability, such a move in FX might call for a more hawkish stance. Against this backdrop, we stand pat with our call for a non-consensus 25bp (or perhaps 50bp) rate cut in October and November.

Risk to our call: The EU deal happening earlier than anticipated and lower September inflation will strengthen the HUF, allowing for a larger rate cut.

Czech National Bank

Our call: First rate cut in November

Rationale: Inflation surprises to the downside, and thanks to base effects and seasonality, the headline rate will be close to the 2% target next January. The Czech National Bank (CNB) staff forecast has been indicating the need to cut rates for some time.

Risk to our call: Weaker FX or an upside surprise in inflation may be a reason to delay the first rate cut until the first quarter of next year.

National Bank of Poland

Our call: The National Bank of Poland (NBP) will cut rates by 25bp in October, with the main policy rate set to decline to 5.5% at the end of 2023. By the end of 2024, the NBP reference rate may decline to 4.75%

Rationale: Following a surprise 75bp rate cut in September, the Monetary Policy Committee is expected to switch to a more cautious approach in order to avoid further downward pressure on the PLN. We expect two 25bp cuts in October and November. In 2024, we see room for an additional 75bp worth of policy easing as inflation is projected to continue moderating in the first half of the year.

Risk to our call: The CPI decline in September (to 8.2% year-on-year) was deeper than the NBP expected and may trigger more bold action from policymakers. This could include a 50bp cut in October, followed by a 25bp cut in November. If accompanied by ultra-dovish rhetoric from the governor then it may cause PLN weakness to resume, worsening the inflationary outlook – and that could require rate hikes in the second half of next year.

National Bank of Romania

Our call: The key rate will remain at 7% until the first half of 2024 and reach 5.5% by the end of 2024

Rationale: Following a slight derailing of the disinflation path in August, significantly higher oil prices, and the likely upside pressures stemming from a higher fiscal burden in 2024, the first National Bank of Romania (NBR) rate cut now looks more likely to occur in the second quarter of next year rather than the first. That being said, with downside pressures on growth also likely to remain strong, we still expect 150bp worth of rate cuts by the end of 2024.

Risk to our call: Downside risks stem from a sharper-than-expected downturn in the German and eurozone economies – Romania’s key trading partners – as well as from higher-than-expected oil supply levels from OPEC. Upside risks stem from wage growth remaining at very high levels, amplifying the stickiness of core inflation, as well as from oil prices remaining very elevated.

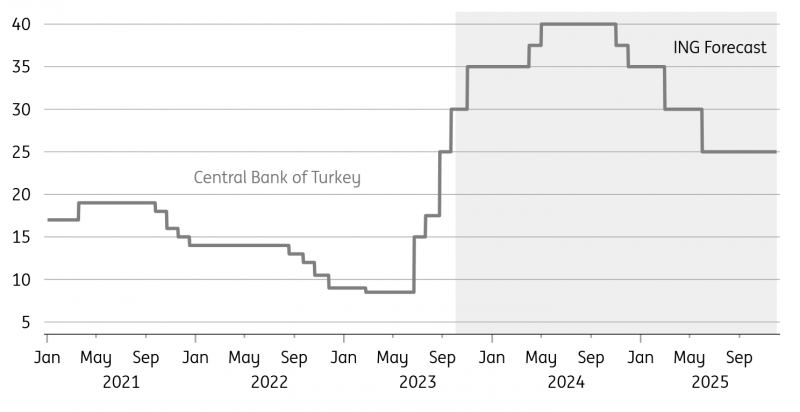

Turkey Central Bank forecast

Macrobond, ING

Central Bank of Turkey

Our call: Policy rate to reach 35% at the end of 2023 and a terminal rate of 40% in early 2024

Rationale: Inflation will likely remain under pressure in the near term, as we have already seen a significant jump in the last two months. Given this backdrop, we expect annual inflation of close to 70% this year and 40% in 2024. Accordingly, the focus of the Central Bank of Turkey (CBT) has remained on anchoring inflation expectations and achieving disinflation. Following 12.5 percentage points of hikes at the previous two meetings, we expect the policy rate to reach 35%, with two more 250bp hikes in both October and November – although a larger hike at the upcoming meeting should not be ruled out.

This would lead to a positive ex-ante real policy rate based on the 33% inflation forecast in the medium-term plan. Macro-prudential tightening should also help disinflation efforts. Given the policy signals, we expect a terminal rate of 40% in early 2024, with another round of hike(s) to tame inflation and attain the projection. Early signals of rate cuts should be expected by late 2024.

Risk to our call: Greater-than-expected price pressures lead to a stronger inflation path and lead to upside risks on our rate trajectory. Equally, pronounced weakness in growth with policy tightening would create downside risks to our call.

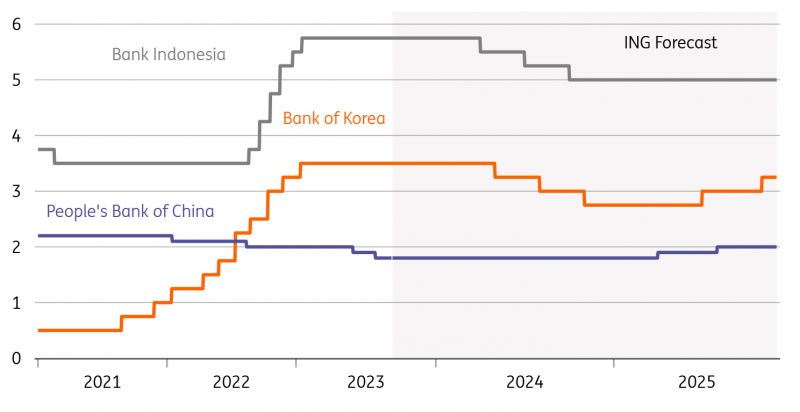

Asia central bank forecasts

Macrobond, ING

People’s Bank of China

Our call: No further changes to the 7-day reverse repo rate

Rationale: The People’s Bank of China (PBoC) has conducted some very minor reductions to its policy interest rates this year but has opted to leave rates unchanged in recent months against the backdrop of depreciation pressures on the CNY. Unless there was a broad-based turn weaker by the USD, we don’t think the PBoC will want to risk cutting rates and then having to deal with the fallout in the FX market.

Risk to our call: Either because it gives up protecting the 7.30 level of the CNY, or because the USD is no longer appreciating, we could see policy rates trimmed again this year.

Reserve Bank of India

Our call: No further changes to the repo rate this year. Rate cuts start in the first quarter of 2024

Rationale: The policy rate of the Reserve Bank of India (RBI) is one of the strongest in the region relative both to the US Fed funds rate and towards its domestic inflation rate, which is falling again after some recent food price spikes. What is probably stopping the RBI from easing earlier is a combination of strong macro momentum, with GDP in the second quarter of this year recording a growth rate of 7.8% – one of the highest in the world – and maintaining a stable INR, which the RBI has clearly been maintaining at around the 83 level to the USD.

Risk to our call: There is room for the RBI to move earlier than we are suggesting, but they may prefer to wait for the US to start easing before they move themselves.

Bank of Korea

Our call: No more rate hikes, but no cuts until the second quarter of 2024

Rationale: The macroeconomy has been showing clear signs of weakness in recent months, with exports and industrial production still declining in year-on-year terms. Despite this, inflation has been on the rise again and is likely to remain above the Bank of Korea’s target rate until the new year.

Risk to our call: We pushed our rate cut call back a little bit recently, but the weakness of the economy may help bring inflation down sooner than expected and result in earlier cuts.

Bank Indonesia

Our call: Bank Indonesia (BI) is likely to keep the rate untouched for the rest of the year

Rationale: Inflation remains well within the target range, and BI recently deployed a new bond purchase program to support the IDR, limiting the need for a rate hike.

Risk to our call: A rate hike by the Fed would force the BI to follow suit in order to maintain an already tight differential of 25bp.

Content Disclaimer:

This publication has been prepared by ING solely for information purposes irrespective of a particular user’s means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more.

Original Post

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Read the full article here