As a former hedge fund manager, I am constantly looking at new investment funds and strategies and I recently came across the FolioBeyond Alternative Income and Interest Rate Hedge ETF (NYSEARCA:RISR), which promises to hold a negative duration fixed income portfolio with a positive carry.

After reviewing the fund’s strategy, I came away quite impressed by the RISR ETF’s strategy and performance. I believe investments like the RISR ETF can help investors mitigate the pain from rising interest rates without having to pay the ‘negative carry’ from traditional short strategies. My only concern with the RISR ETF is the small scale of the fund and investment manager. I rate the RISR ETF a buy.

Fund Overview

The FolioBeyond Alternative Income and Interest Rate Hedge ETF is an actively managed ETF that seeks to provide diversification benefits to traditional fixed income portfolios by investing in interest-only mortgage-backed securities (“MBS”) and U.S. treasury bonds.

What Are MBS IOs?

Mortgage-backed securities are investment securities that are similar to bonds. Each MBS is constructed from a bundle of home loans and other real estate debt that are packaged together by an issuing dealer. Investors in MBS receive periodic payments similar to bond coupons.

However, unlike traditional bonds, MBS has pre-payment risk. When interest rates fall, homeowners are more likely to refinance and prepay their mortgages, hence the duration of MBS may be shortened. Conversely, when interest rates rise, homeowners are more likely to stay in their existing dwellings and MBS duration may be lengthened.

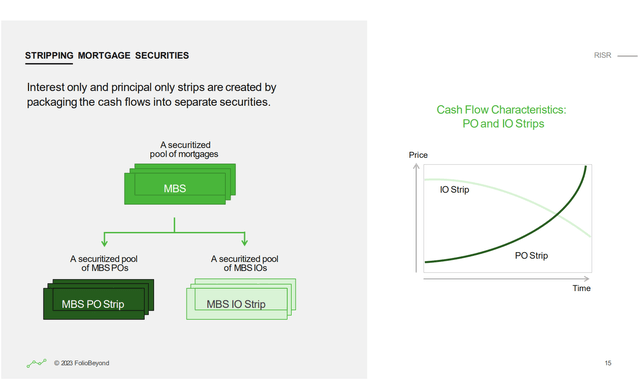

Since the market for MBS is huge (an estimated $11 trillion of MBS are outstanding), some enterprising investment bankers have further financially engineered MBS into interest-only (“IO”) securities and principal-only (“PO”) securities, allowing investors to gain exposure to the specific risks they are willing to bear (Figure 1).

Figure 1 – Illustrative stripping of MBS securities (RISR investor presentation)

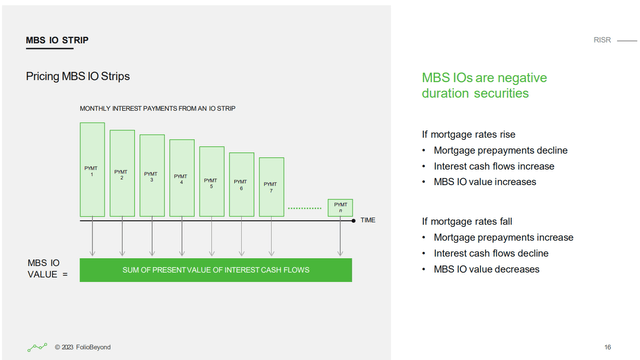

IO strips tend to have high cash flows upfront whereas PO strips tend to have high cash flows in the future. Importantly, IO strips have the important property of being negative duration securities, i.e. as prepayments decline due to rising interest rates, MBS IO strip value increases (Figure 2).

Figure 2 – IO strips have negative duration (RISR investor presentation)

RISR Strategy

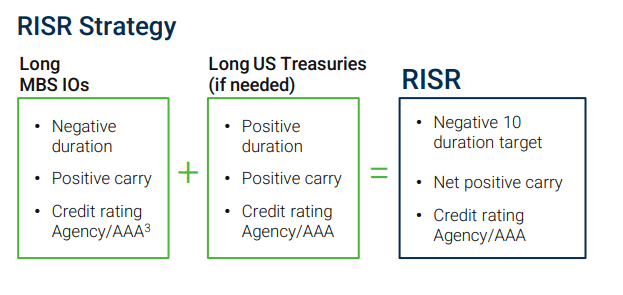

The RISR ETF’s strategy is to combine a portfolio of negative duration MBS IO strips with a portfolio of long treasury bonds to create a portfolio with a target duration of -10 (Figure 3).

Figure 3 – RISR investment strategy (RISR factsheet)

The beauty of RISR’s strategy is that traditionally, to achieve negative duration portfolios, investors will ‘short’ treasury securities or other fixed income securities and will have to pay negative carry (the fund will have to pay the interest payments of the shorted securities). However RISR is able to achieve a negative duration portfolio that also has a positive carry (i.e. the fund will receive interest payments). Furthermore, by investing in agency MBS IO strips, the RISR ETF can maintain investments with the credit backing of the U.S. government.

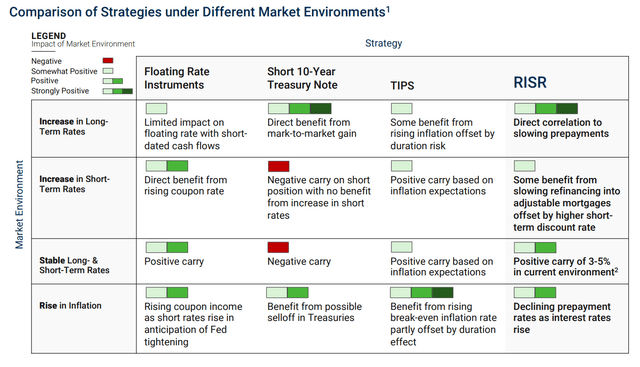

In a rising long-term interest rate environment, the RISR ETF is expected to directly benefit from slowing prepayments with gains similar to being short 10-year treasury notes while there are limited positive impacts from floating rate instruments and TIPs (Figure 4).

Figure 4 – Comparison of RISR strategy to other fixed income strategies (RISR investor presentation)

When short-term interest rates rise while long-term interest rates remain flat (bear flattener), floating rate instruments are expected to perform best as they directly benefit from rising short-term interest rates. However, RISR should outperform being short long-term bonds as it does not suffer from negative carry.

When both long- and short-term rates are stable, the RISR ETF is expected to have a positive carry whereas shorting long-term bonds will have negative carry. Both TIPs and floating rate instruments will also have positive carry in this scenario.

Finally, when inflation is rising, the RISR ETF is expected to benefit from declining prepayment rates as interest rates rise. This is the situation we have been in for the past year-and-a-half.

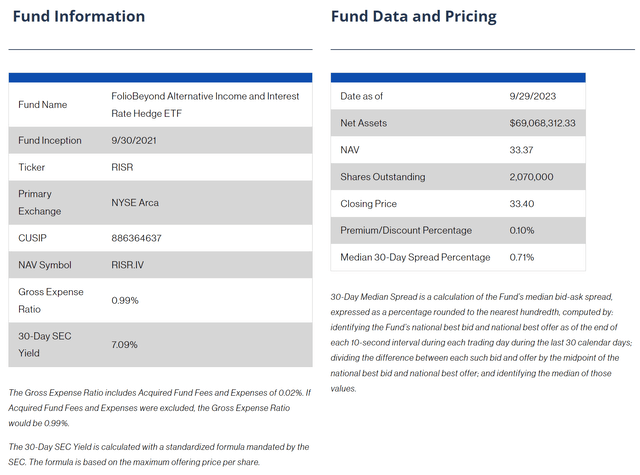

The RISR ETF is a recently launched fund with an inception date of September 30, 2021. So far, the fund has yet to gain much traction, with only $69 million in assets while charging a 0.99% expense ratio (Figure 5).

Figure 5 – RISR overview (foliobeyond.com)

Portfolio Holdings

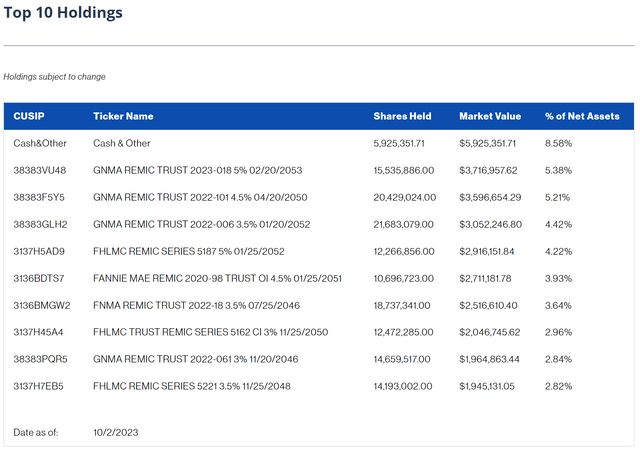

Figure 6 shows the top 10 holdings of the RISR ETF. The RISR ETF holds various agency MBS IO strips.

Figure 6 – RISR top 10 holdings (foliobeyond.com)

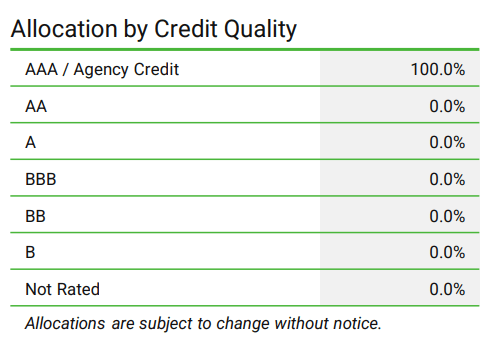

Since the RISR ETF only invests in agency MBS IO strips and treasury bonds, its portfolio is considered to not have credit risk (Figure 7).

Figure 7 – RISR’s portfolio does not have credit risk (RISR factsheet)

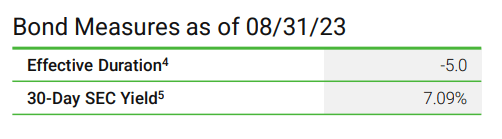

RISR’s portfolio has a portfolio effective duration of -5 as of August 31, 2023 (Figure 7). It is unclear why the fund’s effective duration is -5 instead of -10 as mandated in the factsheet and prospectus.

Figure 7 – RISR’s portfolio has effective duration of -5 (RISR factsheet)

Returns

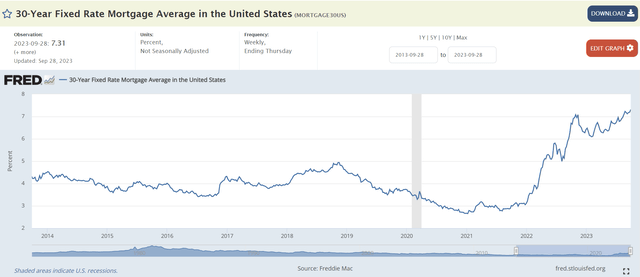

The past 2 years can be considered a perfect launch environment for the RISR ETF as soaring inflation caused the Federal Reserve to raise short-term interest rates aggressively to combat inflation, dragging up long-term yields as well. The rise in interest rates has pushed up 30Yr mortgage rates to the highest in the past decade and has dramatically slowed the housing market, as many homeowners are reluctant to move and lose the ultra low mortgage rates they locked in during the COVID-pandemic (Figure 8).

Figure 8 – 30Yr mortgage rates (St. Louis Fed)

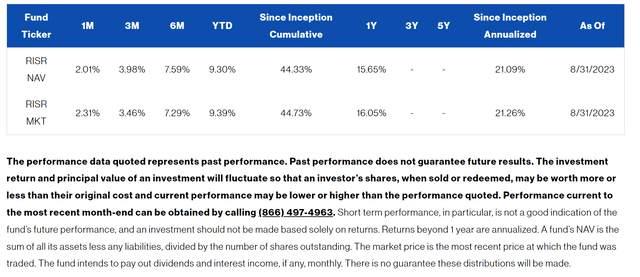

The RISR ETF has performed extremely well as a result, with a 1Yr return of 15.7% to August 31, 2023 and a 21.1% annualized return since inception (Figure 9).

Figure 9 – RISR historical returns (foliobeyond.com)

Distribution

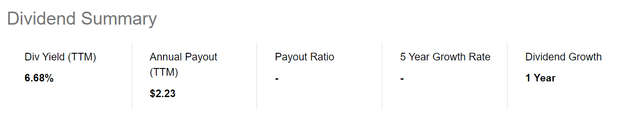

As designed, the RISR ETF not only benefits from rising interest rates (short duration), but it also delivers a positive carry, allowing the ETF to pay an attractive 6.7% trailing 12-month yield (Figure 10). This is akin to ‘having your cake and eating it too’.

Figure 10 – RISR pays a 6.7% distribution yield (Seeking Alpha)

Risks To RISR

The main risk to the RISR ETF is that it is a newly launched fund and we have basically seen the best possible launch environment for this strategy. The strategy has not been tested through the other interest rate scenarios mentioned in Figure 4. For example, if a recession were to hit the U.S. and long-term interest rates fall dramatically as investors scramble for the safety of treasuries, RISR’s negative duration may cause it to suffer steep losses (although this risk may be mitigated by the fact that homeowners tend not to move during recessions so prepayments may not rise materially).

However, the concept of investing in MBS IO strips is not new, so as long as the manager sticks to the fund’s mandate, I don’t see any large risk of the fund ‘blowing up’ from unexpected behaviours of the MBS market.

Another risk to the RISR ETF is operational. FolioBeyond, the fund manager, is a small investment firm launched in 2017. Its only public fund under management is the RISR ETF with less than $70 million in assets. As someone who has run a small hedge fund, I can definitively say that the fees earned from a $70 million ETF are not sufficient to ‘keep the lights on’, let alone pay market rates to a team of high quality portfolio managers and analysts. If the RISR ETF is not able to achieve critical mass in the best possible launch environment for the strategy, then I worry about the sustainability of the investment firm managing the RISR ETF.

Conclusion

The FolioBeyond Alternative Income and Interest Rate Hedge ETF is a novel ETF that can help investors diversify their fixed income portfolios by providing a negative duration investment with positive carry. The RISR ETF achieves this by investing in a portfolio of MBS IO strips and treasury bonds to achieve a target negative duration. In the current ‘higher for longer’ interest rate environment, I believe negative duration investments like the RISR ETF can be very valuable to investors to protect their fixed income portfolios from rising interest rates. I rate the RISR ETF a buy.

Read the full article here