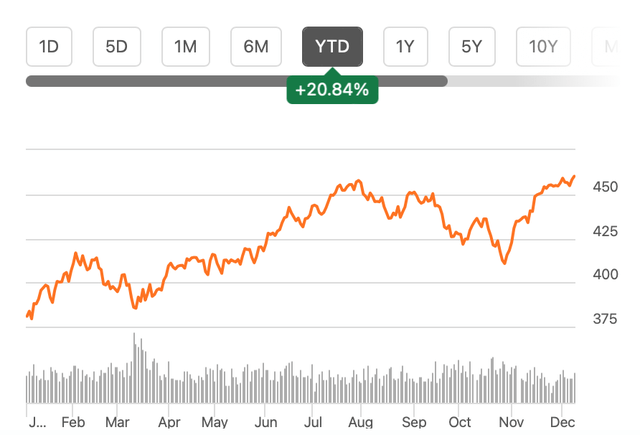

The S&P 500 (SP500) and its replica fund, the SPDR S&P 500 ETF Trust (NYSEARCA:SPY) touched a new 2023 high recently and have now seen a 21% rise year-to-date [YTD]. This is significantly higher than the 11.6% average annual returns seen over the past decade. With the year ending, the big question now is whether the index can continue rising in 2024.

Price Chart, SPY (Source: Seeking Alpha)

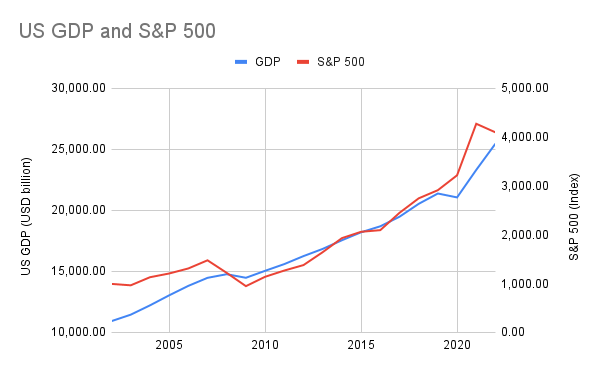

US GDP and S&P 500

With little growth impetus, the macroeconomic context isn’t the most encouraging, indicating that it would be an underwhelming year for the index. To determine how macroeconomy impacts the S&P 500 index, first, the correlation between the average annual S&P 500 index value and the US GDP levels over two decades is considered.

The two series have a strong positive correlation, with a coefficient of 0.94. To put it in perspective, a value of 1 indicates a perfect positive correlation and vice-versa. A 0.94 value then comes very close to a perfect correlation. It follows then, that a good growth for the economy would reflect in the S&P 500 as well.

Source: MacroTrends

A softer average S&P 500 value seen

Except that, it’s not the likely case for 2024. The US economy might have smoothly avoided the speculated recession this year, but a softening in growth is widely seen in 2024. The IMF estimates a sub-trend growth of 1.5% next year.

To determine what this growth means exactly for the S&P 500, a regression was run with the GDP as the explanatory variable. This shows that the average S&P 500 index value next year would turn out to be around 0.75% lower than the level seen this year so far of 4257.2.

This sounds counter-intuitive considering that even at a slower rate, the GDP would still see growth, which should also show up in the index. The expected index correction is explained by the S&P 500’s above-average performance this year, as noted at the start. Or to look at it another way, the average index value in 2023 has been around 3% higher than that indicated by the regression model.

Even as such, after a time when the macroeconomy was a focal point for the stock markets, the economy is now getting into more predictable territory. This means that we are unlikely to see as much market-moving macro data and policy events as we have recently.

Most obviously, the Fed is all but done with the interest rate hikes. Inflation is quite close to its comfort levels, and unlikely to impact market sentiment much going forward either. Further, the Fed’s rate cut cycle is expected to start only late into 2024.

Consider the downside risks

There can be exceptions to this expectation, though, as the rate-cut cycle could start earlier, if GDP growth softens more than expected. It’s not outside the realm of possibility, considering that the IMF’s projection is hardly the worst around. JP Morgan (JPM), for example, expects US GDP growth to come in even slower at 0.7%. The bank is backed by the think tank, Conference Board, which similarly expects 2024 growth to come in at 0.8%.

Interestingly though, even if growth slows down as much, the average S&P 500 index value for the year wouldn’t be very different from the first estimate. The model reveals that it would be around 2% lower than the levels seen this year so far. As would be expected, some sectors, like consumer cyclicals, are likely to bear the bigger brunt of a broad dip in the index.

The likelihood is already coming through in the results for consumer discretionary companies, which have witnessed a softening in demand in the US market in recent months. This is evident across the spectrum from the sportswear and accessories company Adidas (OTCQX:ADDYY) to the luxury jeweller and watchmaker Richemont (OTCPK:CFRUY). I wouldn’t rule out a lacklustre year for other cyclical segments like financials and real estate either.

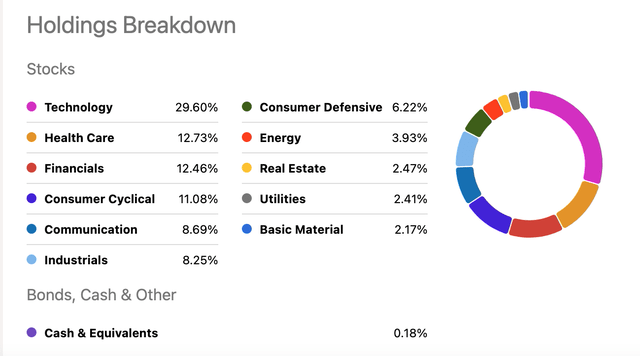

Unlike in 2023, there might not be as much support from big tech either. This is important to note since tech holdings are the biggest in the SPY, with an almost 30% share (see chart below). Stocks like Apple (AAPL) and Microsoft (MSFT) could show some downside next year, going by their relatively elevated forward market multiples, as I pointed out recently. Others like NVIDIA (NVDA) and Amazon (AMZN) can still save the day, going by their forward earnings estimates, but the key point is that the overall upside from tech might still be limited.

SPY Holdings (Source: Seeking Alpha)

It’s not all bad

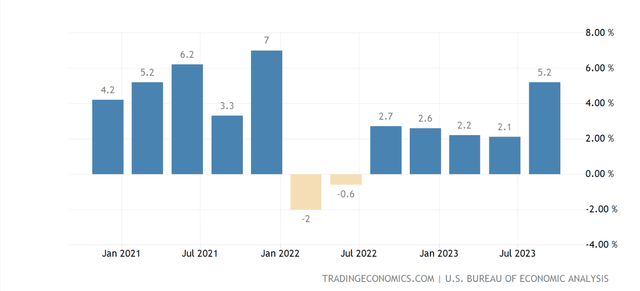

It doesn’t necessarily have to be a washout year, though. While the signs certainly point in the direction of a slowdown in the US economy, there are still indicators pointing to potentially healthy outcomes. So far in 2023, GDP hasn’t exactly slowed down. In fact, in the third quarter (Q3 2023), growth has been at a notable 5.2%, up from an already healthy 2.1% in Q2 2023. The healthy growth completely flies in the face of a widely speculated recession for the economy until earlier this year.

US GDP Growth (Source: Trading Economics)

Also, not all forecasters believe in the growth slowdown story. Goldman Sachs (GS), for instance, predicts a 2.1% growth in 2024, even pointing to the fact that “The US economy defied recession fears in 2023 and made substantial progress toward a soft landing.”. Morgan Stanley (MS), too, sees somewhat higher growth of 1.9%, even if it’s a come-off from the 2.4% estimate for 2023. If this indeed turns out to be the case, the average S&P 500 value will still be largely in line with the numbers seen this year.

What next?

The key point here is, that no matter how we look at it, the correlation between the US economic growth and the S&P 500 doesn’t point to any dramatic changes in the index over the next year. Not if there’s a slowdown, not if there’s better than expected growth.

It does, however, indicate that on average, there could be some correction in the S&P 500 index’s average value in 2024 compared to this year. This is partly due to a softening expected in growth next year, but also because the index has performed significantly outperformed its own average 10-year growth in 2023. Essentially, an underwhelming 2024 for the S&P 500 is the most likely scenario so far.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here