The state of the U.S. economy may be a chief concern among Americans, but 2023 wound up as a pretty good year for the macroenvironment.

Spending remained high, markets posted big gains and the Federal Reserve’s battle against inflation showed signs of cooling — without freezing. Then there’s the almost logic-defying resilience of the job market.

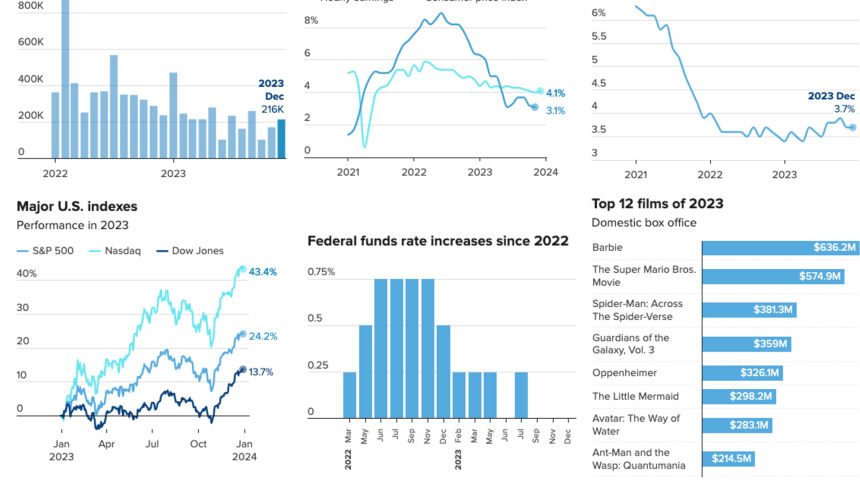

The U.S. labor market ended the year strong, creating more than 200,000 jobs in December, according to figures released Friday by the U.S. Bureau of Labor Statistics. While previous job creation estimates for October and November were revised downward by a combined 75,000, the unemployment rate remained at a low 3.7%, and December marked the 36th consecutive month of job creation for the U.S. economy.

In total, the U.S. created nearly 2.7 million jobs in 2023, when seasonally adjusted. That figure came despite concerns that the Federal Reserve’s ongoing fight against inflation through interest rate hikes might cool the labor market and put a chill on consumer spending.

Neither of those concerns came to fruition, however. In fact, consumer spending remained robust throughout the year, with monthly advanced retail sales staying above the $600 million mark for most of 2023, proving that despite many economic headwinds, U.S. consumers could not be deterred.

Here are nine other charts that show how the economy rounded out 2023.

Inflation, wages and spending

While inflation continues to be top of mind for U.S. consumers, the rate of inflation cooled significantly in 2023. Meanwhile, wages rose throughout the year, eventually outpacing price increases.

U.S. consumers were in a mood to spend, particularly on experiences: 2023 was officially the year that travel rebounded, with the Thanksgiving holiday period breaking U.S. records. Nearly 150 million passengers were screened by the Transportation Security Administration across U.S. airports in November and December.

Americans spent on entertainment, too. With major hits such as “Barbie,” “Oppenheimer” and Taylor Swift’s The Eras Tour concert film, the U.S. box office came back in a big way last year from its Covid-19 pandemic lows.

Markets

Even assets such as crypto saw a rebound in 2023 after hitting a low in November of the previous year. Bitcoin prices ended the year at almost three times that previous low.

Interest rates and housing

After its historic rate increases in 2022, the Federal Reserve tempered its war on inflation and only raised rates at four of its eight meetings in 2023. While the central bank’s target range for interest rates is the highest it has been since 2006, recent comments from Chair Jerome Powell have Fed watchers optimistic that rate cuts may be coming in 2024.

There were some trouble areas for consumers, however. Mortgage rates continue to be high. The average 30-year fixed rate in October was nearly triple what it was at the end of 2020 — although rates came down significantly by the end of the year — and existing home sales remain low, according to data from the National Association of Realtors. Until more housing inventory comes online, those issues are likely to persist into 2024.

Don’t miss these stories from CNBC PRO:

Read the full article here