The bullish thesis about buying into UnitedHealth Group Incorporated (UNH) is simple. It’s a leading, wide-moat, well-integrated healthcare player that has proven its ability to generate sustainable profitability. As such, UnitedHealth benefits from distinct large-scale cost advantages and efficiencies that help it defend against smaller players in the managed healthcare space.

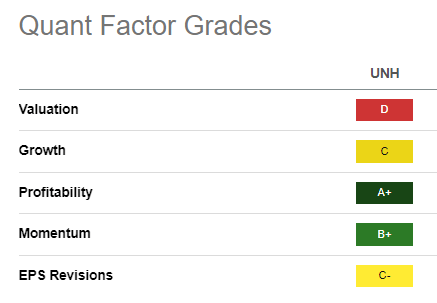

UNH Quant Grades (Seeking Alpha)

As such, UNH has consistently traded at a premium relative to its growth prospects, notwithstanding its best-in-class “A+” profitability grades, justifying its wide-moat model.

Seeking Alpha Quant assigned a “D” valuation grade to UNH and a “C” growth grade, indicating its relative premium. Yet, that hasn’t prevented UNH from delivering a market-beating 10Y total return CAGR of 23.4% over the past ten years.

However, its 5Y total return CAGR of 15.3% suggests that its best days of significant market outperformance could be over, given UNH’s relative premium. In other words, investors who expect another “easy” beat over the next ten years might be disappointed.

The company’s revenue base is led by the market-leading health insurer UnitedHealthcare. It also had a fast-growing healthcare provider in OptumHealth, which delivered a 36% YoY growth in revenue in Q2. As part of the Optum segment, its pharmacy benefit manager or PBM is anchored by OptumRX, which experienced a 15% YoY revenue growth. Supplemented by the 42% growth in its healthcare analytics segment, OptumInsight, UnitedHealth delivered a total revenue growth of 15.6% in Q1.

Analysts’ estimates of UnitedHealth’s ability to deliver relatively strong revenue growth and profitability over the next two years remain favorable. Accordingly, the company is expected to post a revenue CAGR of 9.4%, suggesting a marked deceleration from the current growth cadence. As such, it’s discernibly lower than UnitedHealth’s 10Y trailing twelve-months or TTM revenue CAGR of 11.4%.

Despite that, its market leadership is expected to sustain its ability to post robust operating leverage, leading to an adjusted EPS CAGR of 12.5%. As such, I believe UNH’s “A+” profitability grade should continue to attract investors at steep pullbacks into highly attractive valuation zones.

However, it’s also crucial for investors to consider the evolving landscape that could impede the profitability trajectory of managed healthcare players like UNH. Investors must pay attention to possible regulatory changes that could aim at lowering the health insurance and prescription costs for consumers, hitting UNH’s profitability moat.

Although I am convinced that UnitedHealth’s market leadership should help sustain its competitive advantages, the managed healthcare space as a whole could be affected. As such, UNH wouldn’t be immune to a broad rotation out of the space as investors seek more attractive opportunities with less disruptive regulatory challenges.

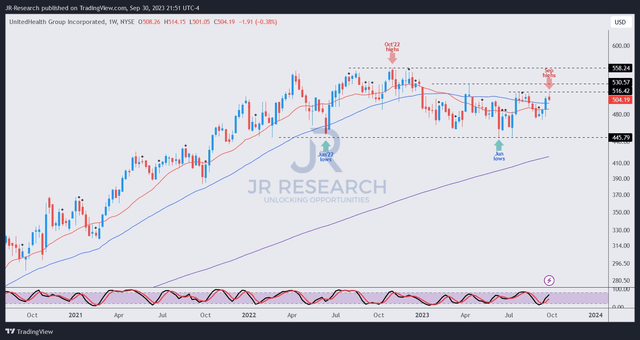

UNH price chart (weekly) (TradingView)

As seen above, UNH topped out in October 2022 as investors rotated out of defensive plays, taking advantage of the market bottom in the S&P 500 (SPX)(SPY) by going risk-on.

However, UNH buyers returned to hold its $445 support zone firmly, which has remained in play since early 2022. As such, I believe it’s a critical support level that should continue to attract dip buyers aggressively if re-tested.

Notwithstanding my optimism, I assessed sellers are holding back against UNH’s buyers looking to recover its uptrend bias at the $515 level since July 2023.

It’s a critical level that buyers must break through decisively for UNH to recover its upward momentum, but it seemingly lacks sufficient buyer conviction.

Key Takeaway

UnitedHealth is undoubtedly a worthy consideration as a core healthcare play for healthcare-focused investors. However, given its premium valuation, its “C” growth grade suggests caution. UNH’s much lower 5Y total return relative to its 10Y average suggests that its best days for market outperformance could be over.

Analysts’ estimates also align with my thesis, suggesting topline growth could slow further. However, its best-in-class profitability moat is expected to be sustained despite the evolving regulatory landscape that must be watched closely.

Investors looking to add more exposure can consider adding closer to its $445 support zone to improve their risk/reward for potential market outperformance. For now, I encourage investors to wait on the sidelines until a steeper selloff occurs.

Rating: Initiate Hold.

Important note: Investors are reminded to do their due diligence and not rely on the information provided as financial advice. Please always apply independent thinking and note that the rating is not intended to time a specific entry/exit at the point of writing unless otherwise specified.

We Want To Hear From You

Have constructive commentary to improve our thesis? Spotted a critical gap in our view? Saw something important that we didn’t? Agree or disagree? Comment below with the aim of helping everyone in the community to learn better!

Read the full article here